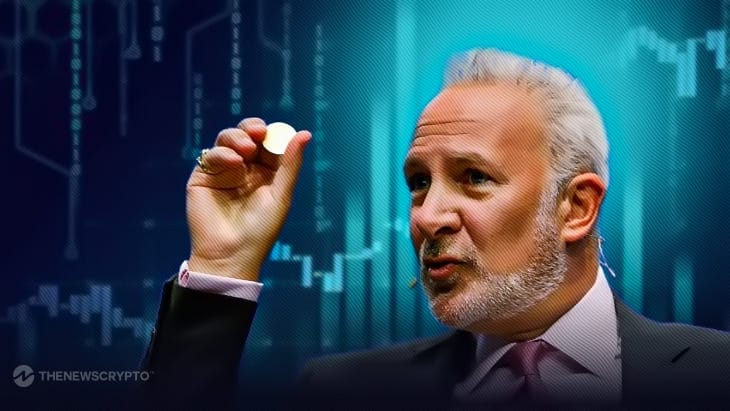

- The stock price of MSTR has fallen 30% from its March high, as pointed out by Peter Schiff.

- Hedge funds dumping BTC will add to the selling pressure on the cryptocurrency market.

Notable gold investor Peter Schiff has warned that hedge funds are preparing to sell their Bitcoin holdings and initiate short bets on MicroStrategy. This is a huge shift in opinion about the most popular crypto and the software company that is famous for having a lot of Bitcoin.

Companies like MicroStrategy, have substantial investments in digital assets. Thus, are understandably worried about the consequences of the increasing doubt about Bitcoin’s worth, which is why Schiff is sounding the alarm.

Peter Schiff, a well-known investor and economist, has recently made headlines by sounding the alarm about hedge funds. That are preparing to sell Bitcoin while expanding their short holdings on MicroStrategy (MSTR). The stock price of MicroStrategy has fallen 30% from its March high, as pointed out by Peter Schiff.

High Volatility Anticipated

Hedge funds who had been protecting themselves from Bitcoin’s volatility by shorting MicroStrategy’s shares while owning Bitcoin are now changing their strategy. Schiff claims that these hedge firms will now short MSTR exclusively and sell their Bitcoin holdings.

Moreover, the current decline in MicroStrategy’s stock price may be accelerated. If this strategy shift causes these funds to sell their Bitcoin holdings, adding to the selling pressure on the cryptocurrency market.

They consider this as a strategic move to make the most of their short positions in MSTR shares. By taking advantage of the drops that they expect to happen. MicroStrategy’s CEO Michael Saylor has been in the spotlight recently due to the firm’s substantial Bitcoin holdings.

Nevertheless, hedge funds seeking to profit from what they view as vulnerabilities in the cryptocurrency market have targeted the company’s shares due to its strong correlation with Bitcoin’s price fluctuations.

Highlighted Crypto News Today:

Bitcoin Sees Massive Sell-Off, Miners Liquidate BTC Worth $2 Billion