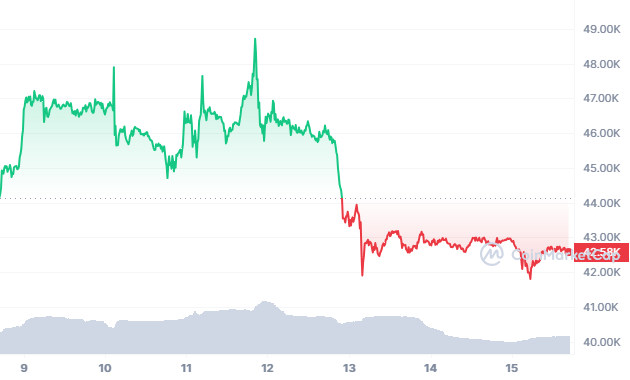

- At the time of writing, bitcoin is trading at $42,561, down 0.70% in the last 24 hours.

- If the price manages to go below the $41,890 mark then the price will likely test $41,100.

The newly issued iShares Bitcoin Trust ETF (IBIT) from financial behemoth BlackRock is being promoted in a subtle and unobtrusive manner, which is a departure from the norm. Some may find it dull, but experts in the field think it might be the key to luring the wealthy group.

A few days ago, BlackRock debuted a video commercial for the iShares Bitcoin Trust ETF. The commercial, which runs for around two minutes, has an executive from BlackRock explaining the benefits of Bitcoin and how investors may purchase shares in the ETF. Unlike many other Bitcoin ETF advertising, BlackRock’s approach is simple and doesn’t use crypto jargon.

Consolidation Phase

Much of the initial fervor around the Bitcoin ETF has already died down, and the much-anticipated correction in the cryptocurrency market has started. Nonetheless, a further price decline may be in store as a result of the declining interest in Bitcoin on key exchanges. Following the ETF, several analysts correctly predicted a possible market slump.

Last week’s weekly candlestick pattern suggests that “sideways and down” price behavior leading up to the 2024 halving event will be the norm for Bitcoin over the next several months.

At the time of writing, bitcoin is trading at $42,561, down 0.70% in the last 24 hours as per data from CoinMarketCap. Moreover, the trading volume is up 34.21%.

The price has been consolidating lately after facing severe selling pressure. If the price manages to go below the $41,890 mark then the price will likely test $41,100 support level. However, if the price manages to go above $43,210 then it will likely surge further to test $43,990 resistance level.