- At the time of writing, Bitcoin is trading at $45,060, up 2.12% in the last 24 hours.

- If the price manages to climb above $45,800 level, then it will likely test $48,400 level.

With Bitcoin’s price rising back above $45,000, crypto investors had every reason to be excited at the start of the new week. Early reports indicated that on January 5, BlackRock bought $10 million worth of Bitcoin. The investment firm had anticipated a volume of over $2 billion for its Spot Bitcoin ETF.

Last week, the price of Bitcoin hit $42,000 after a drop caused by a research by Matrixport that highlighted the low likelihood of ETF approvals.

Highly Anticipated Approval

The market experiences a cloud of fear of missing out (FOMO) because of the highly anticipated Bitcoin ETF decisions, which has caused even whales to go on a purchasing binge.

After purchasing 6,000 BTC ($158.66M) at $26,444, a prudent investor acquired 1,750 BTC ($76.9M) from Binance at an average price of $43,953. The investor made $26.4 million after dumping 3,000 bitcoins ($105.7 million) to Binance at $35,241.

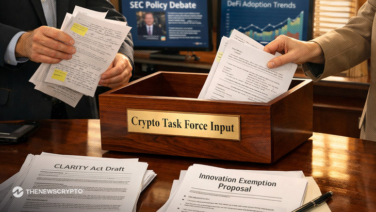

The U.S SEC has cautioned people against investing in cryptocurrencies due to the fear of missing out (FOMO) amidst ongoing anticipation of a Bitcoin Spot ETF approval. Using social media, the SEC’s educating arm issued a warning against fear of missing out (FOMO) investing.

At the time of writing, Bitcoin is trading at $45,060, up 2.12% in the last 24 hours as per data from CoinMarketCap. Moreover, the trading volume is up 62.75%.

If the price manages to climb above $45,800 level, then it will likely climb further to test $48,400 resistance level. On the other hand, if the price manages to go below $44,030 level, then it will likely decline further to test $43,750 support level.