- Bitcoin daily chart signals a bearish trend with 9d EMA at $36,587.

- Grayscale in Ongoing Talks with SEC for Bitcoin Trust Conversion to ETF.

The last twenty-four hours in the volatile world of cryptocurrency have been a whirlwind following the unexpected resignation of CZ Binance, the renowned figure and CEO of the largest exchange, Binance. His departure comes hand-in-hand with a staggering $4 billion settlement between United States agencies, shaking the global market capitalization, which took a 3% dip within the same timeframe. The repercussions were felt even by Bitcoin, the leading cryptocurrency by market capitalization.

Bitcoin witnessed a 2.17% decline in its value, settling at $36,509, and a 2% reduction in its market cap. Meanwhile, BNB faced a steeper decline of 10%. Despite this, Bitcoin’s trading volume surged by 34%. Concerns are now rising within the community about the strong bullish rally of Bitcoin, which enjoyed a nearly 23% surge in the last 30 days, potentially being overtaken by bearish trends.

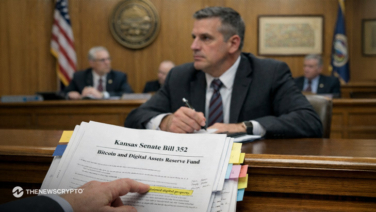

Meanwhile, in a parallel development, efforts to drive bullish sentiments persist with talks of a Bitcoin ETF. Executives from Grayscale, a crypto asset manager, engaged in discussions with the Securities and Exchange Commission regarding details of converting its flagship Bitcoin trust into a spot Bitcoin exchange-traded fund (ETF).

A Nov. 20 SEC memo revealed that Grayscale’s CEO Michael Sonnenshein, legal chief Craig Salm, ETF head Dave LaValle, and other executives, alongside representatives from the Davis Polk law firm, met with the SEC’s division of trading and markets. The focus revolved around NYSE Arca, Inc.’s proposed rule change to list and trade shares of the Grayscale Bitcoin Trust under NYSE Arca Rule 8.201-E.

Further, Grayscale disclosed an agreement with BNY Mellon through a Transfer Agency and Service Agreement, as shared in a filing by Bloomberg ETF analyst James Seyffart.

Bitcoin Bears in Charge?

Amidst these developments, analyses of Bitcoin’s price movements paint a precarious picture. The daily chart shows a potentially bearish trend, with the 9-day exponential moving average (EMA) currently positioned above the trading price at $36,587. However, the daily relative strength index (RSI) suggests a neutral condition, standing at 57.

Prospects indicate a potential fresh rally towards the $40,300 mark if the price manages to surpass the $38,000 level. Conversely, a downturn below the $36,440 mark could test the $32,792 support level.