- BIS says banks face risks such as operational, security, governance, legal, and compliance issues with permissionless blockchains.

- Open blockchains raise privacy concerns with visible transactions, and pseudonymity offers limited protection from cyberattacks.

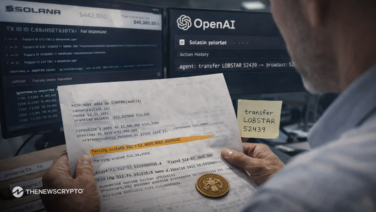

The Bank for International Settlements (BIS) recently highlighted the complexities and risks banks face when engaging with permissionless blockchains in its latest working paper, published on August 28. The report from the Basel Committee on Banking Supervision outlines several concerns tied to these decentralized systems.

One key issue is the challenge of ensuring settlement finality. The paper stated that while the technology to mitigate some risks, particularly privacy issues, is evolving—such as zero-knowledge proofs—many solutions remain in development and have not yet been stress-tested.

Key Risks Identified for Banks Using Permissionless Blockchains

The BIS report identifies a range of risks, including operational, security, and governance issues. The reliance on unknown third parties complicates due diligence and oversight for banks. Moreover, the open nature of some blockchains, which allow public access to transactions, raises privacy concerns. While pseudonymity offers some level of anonymity, it does not fully safeguard against privacy breaches and can expose users to potential cyberattacks.

According to the BIS report, political and legislative changes also pose risks. They believe that alterations in regulations could affect the stability of blockchains by influencing validator behavior or impacting the computing power needed to secure the network, potentially increasing vulnerability to attacks like the 51% attack.

The paper also highlights how the pseudonymity of blockchain transactions can complicate compliance with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations. This This complexity makes it challenging for banks to ensure they are not dealing with illicit actors.

Overall, the BIS report emphasizes that solutions are being developed. However, integrating permissionless blockchains into traditional banking systems requires careful consideration of these evolving risks.

Highlighted Crypto News Today