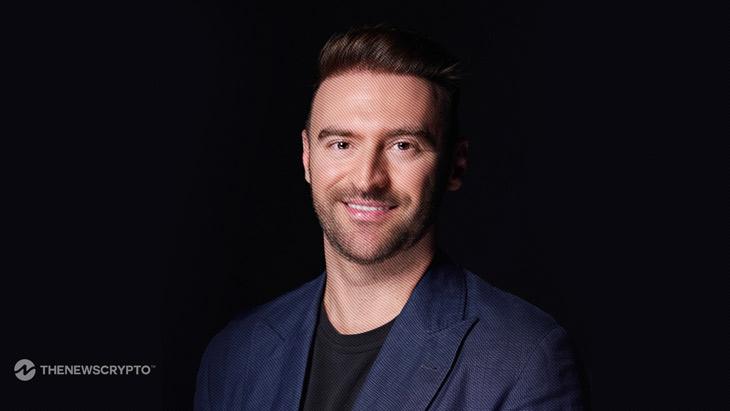

With a profound understanding of the blockchain industry and a proven track record of successful investments in Ethereum, Fantom, block.one, Cosmos, Polkadot, and more, billionaire investor Stelian Balta is recognized for his strategic insights and contributions to the growth of the blockchain ecosystem, boasting over 150 investments in the space. Since his humble beginnings as a game developer, Stelian Balta has evolved into a prominent figure in the blockchain and web 3.0 industry since 2013.

Best known as the founder and CEO of HyperChain Capital, one of the earliest digital assets management companies dedicated to investing in blockchain projects and decentralized protocols, Mr. Balta’s leadership at HyperChain Capital underscores his expertise in identifying and nurturing innovative digital asset ventures. This highlights his unwavering commitment to the advancement of blockchain technology.

As a seasoned investor with a solid track record, how do you view the role and impact of cryptocurrency both as a technological innovation and as an investment option in today’s financial landscape? – I always see crypto in two ways: as a technology and as a novel asset class. From a tech standpoint, it represents a groundbreaking shift, offering decentralization, transparency, and security through blockchain technology. On the other hand, as an asset class, crypto offers a unique investment opportunity, uncorrelated with anything previously seen in traditional finance. It’s a new frontier in the financial world that attracts investors for its high growth potential, though it also carries greater risks. So, crypto is not just about making transactions or investments; it’s about shaping the future of how we deal with money and technology.

Can you summarize the most significant developments in the crypto market over the past year, and how they have impacted investor sentiment? – Recently, the cryptocurrency sector has experienced a notable upswing, influenced by favorable U.S. macro trends and augmented institutional participation. This progress is exemplified by the anticipated approval of a Bitcoin spot ETF, marking a significant milestone that could bring hundreds of billions into the market. At the same time, improvements in blockchain technology and clearer regulations have strengthened investor confidence.

What are the key factors driving institutional investors towards cryptocurrencies, and how do you foresee this influencing the overall stability and growth of Web3.0? – I think institutional investors are increasingly attracted to cryptocurrencies, especially Bitcoin, for diversifying their portfolios with uncorrelated novel assets. The growing interest from institutional investors in these digital assets is fueled by clearer global regulations for crypto, making it a safer bet for their investments. Plus, new products based on cryptocurrencies, like ETFs, will be introduced, making it more accessible and familiar for these investors to get involved.

How do you foresee the evolution of DeFi impacting traditional financial systems in the coming year? – DeFi makes financial services more accessible, especially to those who are unbanked or underbanked around the world. The use of blockchain technology in DeFi can lead to faster, cheaper, and more efficient financial transactions. Traditional financial systems might adopt similar technologies to speed up their processes and reduce costs. As DeFi grows, it will likely attract more regulatory attention, which is welcomed, and this could lead to new efficient regulations that might improve both DeFi and traditional finance, possibly leading to a more secure and stable financial environment.

What are your market predictions for cryptocurrencies in 2024? – Forecasting the direction of the cryptocurrency market is not a precise discipline, and a few of my past attempts at forecasting have often been off the mark. What I’ve learned in the past 10 years is that the crypto market is highly dynamic and influenced by a myriad of unexpected factors, making accurate predictions challenging. However, one aspect I am confident about is the continuous innovation within the crypto space. This is leading to the creation of new and exciting products in the cryptocurrency space, as fresh minds bring in new ideas and technologies. I have never seen so much innovation in crypto as I see now.

As we anticipate interest rates to start declining in 2024, lower rates typically make traditional investments less attractive, leading to a search for alternative opportunities, such as in the innovative realms of crypto.

I am optimistic about the prospects of Layer 1 blockchains like Ethereum and others following the approval of Bitcoin spot ETFs in the US. The approval of an Ethereum spot ETF in the US, for instance, could serve as a gateway for traditional investors to explore a new asset class, diversifying their portfolios and introducing them to the innovative world of blockchain technology and digital assets. This development may signify a major shift in investment strategies, as it bridges the gap between conventional financial markets and the emerging digital economy and could potentially bring hundreds of billions into the market. In summary, while the exact trajectory of market behavior in 2024 is uncertain, the crypto ecosystem is likely to experience a surge in creative and technological advancements, driven by an expanding pool of developers and innovators entering the field.

What blockchain initiatives are you currently most enthusiastic about? – One of the projects that I have immense admiration for is Fantom, a prominent layer-1 network with a reliable 99.5% uptime, even amidst the latest trends. A key differentiator for Fantom is its innovative approach to accelerators. The current Sonic Labs program, featuring mentorship from Andre Cronje and offering unique go-to-market support, stands out in this space. Additionally, ecosystem developers have the opportunity to earn more on Fantom than on any other blockchain platform, thanks to gas monetization. With the upcoming Sonic stack upgrade in 2024, Fantom is poised to scale up to over 200 million transactions per day. Looking ahead, with more than 40 years of runway and continuous technological and business model improvements, I expect Fantom to increasingly dominate the blockchain space and become a well-established name in the industry.

Considering the changing world of digital currencies and their growing global acceptance, how do you view the chances of countries and large companies adopting Bitcoin as part of their formal financial plans in the future? – Looking ahead, I wouldn’t be surprised to see nation-states adding Bitcoin to their financial strategies. As Bitcoin gains global recognition and stability, it’s becoming an increasingly viable asset for diversified portfolios. This trend could extend to national governments seeking to hedge against traditional financial market volatility and strengthen their economic positions. The potential for Bitcoin to serve as a reserve asset, much like gold, may become appealing to forward-thinking countries exploring new economic paradigms. Additionally, the Financial Accounting Standards Board (FASB) has decided to use Fair Value Accounting for Bitcoin starting from fiscal years after December 15, 2024. This change in accounting rules will facilitate the adoption of Bitcoin as a treasury reserve asset by global companies.