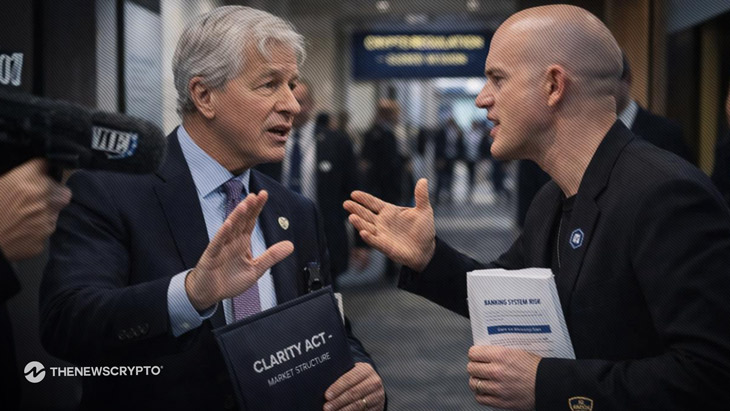

- Brian Armstrong and Jamie Dimon had a public disagreement over the CLARITY Act during a discussion.

- Coinbase has pulled its support for the CLARITY Act in its current form.

A high-profile showdown between Coinbase and major U.S. banks has again brought the CLARITY Act into the limelight. The proposed crypto market structure bill is now pending in the Senate. At the World Economic Forum in Davos, a heated exchange occurred between Coinbase CEO Brian Armstrong and JPMorgan CEO Jamie Dimon over the current provisions of the bill. This has highlighted the tension between the traditional financial sector and the rapidly developing digital asset industry.

As per the report from WSJ, the lawmakers are trying to pass the CLARITY Act through Congress, with the Senate Agriculture Committee already voting to approve its part of the bill. The CLARITY Act aims to create a clear and comprehensive national regulatory framework for digital assets by harmonizing their regulation. This also clarifies the role of regulators such as the SEC and CFTC.

Coinbase Pulls Back Support Over Bill Details

Armstrong has stated that Coinbase will not support the CLARITY Act as it is now, as it may limit the ability of exchanges to provide yield products for stablecoins. He stated that the inherent components of the bill may impact the income of the crypto community and the freedom of choice that individuals have.

On the other hand, banking executives such as the CEO of Bank of America, Brian Moynihan, have called for the regulation of companies that provide products similar to deposits. This has emphasized the conflict between digital asset products and financial regulations. During the event, the executives of Wells Fargo and Citigroup were said to have kept their distance from Armstrong.

The CLARITY Act is soon to enter new territory as it progresses towards being considered by the Senate Banking Committee. The first order of business is to secure approval of its part of the legislation before any debate can take place in the Senate. The presence of partisan tensions is further complicating the situation, with Democrats said to be against the legislation during the committee debate on an ethics amendment.

White House Meeting on Stablecoin Policy and Regulation

As a reaction to the recent political turmoil, the White House has established a policy meeting where bankers and representatives of the crypto industry will discuss the CLARITY Act and other regulatory matters. The meeting is likely to focus on stablecoin regulation and will feature questions, with senior policy officials leading the conversation instead of CEOs.

The meeting is likely to pave the way for further discussions in the future on stablecoin yields, market structure, and other regulatory issues in the financial and crypto industry. The disagreement on the CLARITY Act reveals a deep divide between major crypto exchanges and traditional financial institutions on the regulation of digital assets in the U.S. Coinbase’s withdrawal of support for the Act reveals concerns that some of its provisions could stifle innovation in the crypto industry, especially with regard to stablecoin yield products. While bank executives stress compliance and risk management, the upcoming White House policy briefing is a critical point in reconciling disparate industry views and moving the legislative process forward.

Highlighted Crypto News

Ethereum Foundation Enters Period of Mild Austerity, Says Vitalik Buterin