- Avalanche (AVAX) experiences a price decline amidst market volatility.

- Large-scale unstaking of AVAX tokens signals bearish sentiment among long-term investors.

- Technical indicators suggest potential further downside for AVAX, with $20 as a possible target.

Avalanche (AVAX) finds itself caught in a downward spiral. The digital asset has shed a quarter of its value in the final days of July, plummeting below the crucial $25 threshold.

This stark decline comes at a time when the broader crypto ecosystem is grappling with a mix of bullish and bearish catalysts, ranging from political statements to regulatory developments.

The Curious Case of Avalanche’s Underperformance

While some cryptocurrencies have managed to capitalize on recent market optimism, AVAX stands out as an anomaly. Its 25% decline over a 10-day period contrasts sharply with the double-digit gains observed in assets like XRP, BCH, and BTC.

This divergence hints at underlying issues specific to the Avalanche ecosystem, overshadowing any positive sentiment from the wider market.

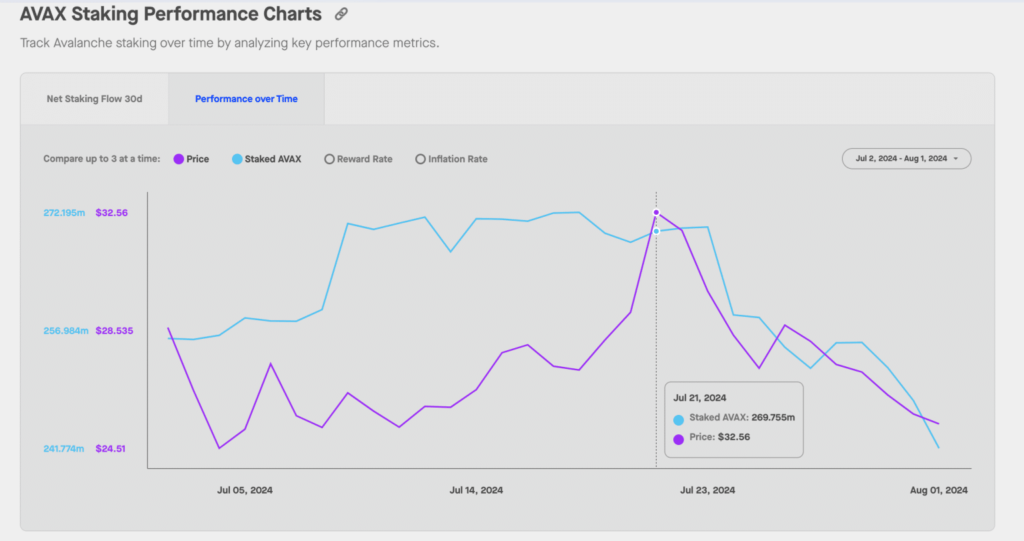

Delving into on-chain metrics reveals a troubling trend among Avalanche’s core stakeholders. Data from StakingRewards.com paints a picture of mass exodus from staking contracts, with over 28 million AVAX tokens (valued at approximately $700 million) withdrawn in just ten days.

This unprecedented unstaking activity serves as a barometer for waning confidence among long-term investors and node validators.

The sudden influx of previously staked AVAX tokens into circulation presents a double-edged sword for the asset’s market dynamics. Not only does it dilute the short-term supply, potentially putting downward pressure on price, but it also sends a powerful signal to prospective investors.

The large-scale unstaking could be interpreted as a vote of no confidence in AVAX’s near-term prospects, potentially deterring new entrants to the market.

A closer examination of AVAX’s daily chart reinforces the bearish narrative. The widening Bollinger Bands indicate increased volatility, with the price currently hugging the lower band – a sign of sustained selling pressure.

Meanwhile, the Commodity Channel Index (CCI) plunges deep into oversold territory, registering a reading of -134.69.