- AVAX trades in an ascending channel since August 6, up 5% from August 5 lows.

- Bullish indicators include positive MACD crossover and funding rates.

- Conflicting signals from RSI and CMF suggest potential limitations to upward momentum.

Avalanche (AVAX) is moving through an ascending channel formation. This price pattern, which emerged on August 6 following a broader market downturn, has seen AVAX climb 5% from its August 5 closing price of $19.54 to its current trading level.

The ascending channel, characterized by a flat upper resistance line and a rising lower support line, typically signals a gradual accumulation of buying pressure.

This formation suggests that while AVAX buyers are steadily gaining strength, sellers maintain a consistent resistance level, creating a dynamic tension in the market. Technical indicators offer mixed signals regarding AVAX’s short-term prospects.

The Moving Average Convergence/Divergence (MACD) indicator has flashed a bullish signal, with the MACD line crossing above its signal line on August 17. This crossover often precedes a rally, indicating a potential shift from bearish to bullish momentum.

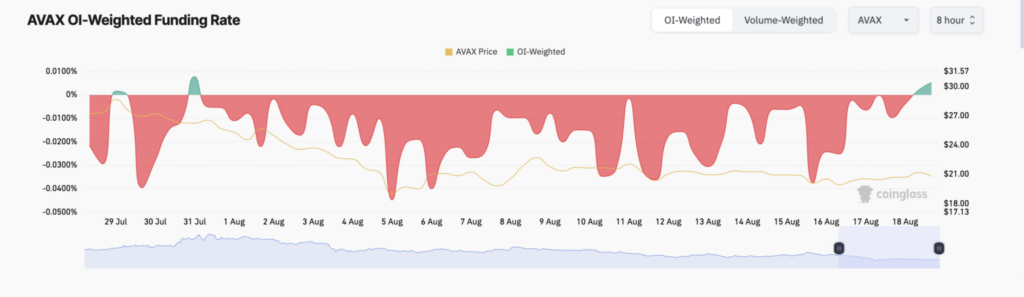

Avalanche funding rate turns positive

Supporting this optimistic outlook, AVAX’s funding rate across exchanges has turned positive for the first time since early August. This metric suggests a growing appetite for long positions among futures traders, reflecting increased confidence in AVAX’s upward potential.

However, not all indicators align with this bullish narrative. The Relative Strength Index (RSI) stands at 39.53, well below the neutral 50 level, indicating that selling pressure still outweighs buying interest.

Similarly, the Chaikin Money Flow (CMF) remains in negative territory, suggesting that despite recent price gains, buying pressure has yet to overcome ongoing distribution.

These conflicting signals paint a complex picture of AVAX’s market dynamics. While the ascending channel and positive MACD crossover hint at potential upside, the underwhelming RSI and negative CMF serve as cautionary flags, tempering expectations for a sustained rally.