- Due to Holon Investments’ non-compliant TMD, ASIC has suspended funds.

- Holon’s investment is indeed the ability to sell or distribute three cryptocurrency funds to retail investors.

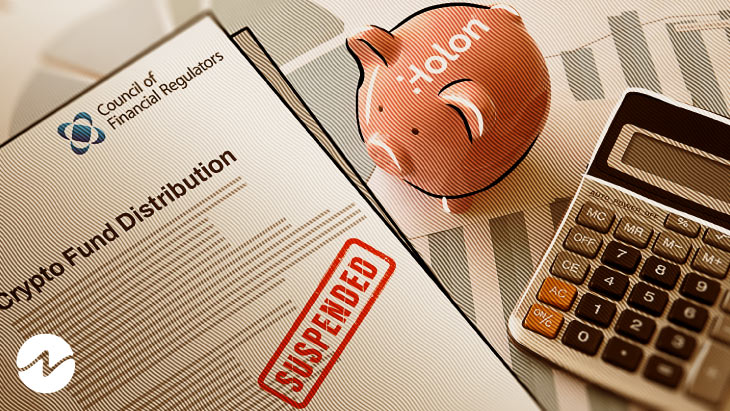

According to a press release, the Australian Securities and Investment Commission (ASIC) has suspended Sydney-based asset manager Holon Investments’ ability to sell or distribute three cryptocurrency funds to retail investors for 21 days.

ASIC has made interim stop orders preventing Holon Investments Australia Limited from offering or distributing three funds to retail investors because of non-compliant target market determinations. https://t.co/AXpqgdAQnl

— ASIC Media (@asicmedia) October 16, 2022

Holon’s Funds Are Not Suitable for Investors

Due to Holon Investments’ non-compliant target market determinations (TMD), ASIC had to make the decision. The TMD is a document that outlines the target market for a particular investment product. ASIC was concerned that Holon did not adequately take into account the attributes and risks of the Funds when deciding on their target markets.

According to the regulator, the broad target market stipulated in Holon’s TMDs, which includes investors with potentially medium, high, or very high risk and return profile information, is not a good fit for the cryptocurrency funds.

The funds held by Holon in Bitcoin, Ethereum, and Filecoin are affect the suspension. The cryptocurrency exchange Gemini oversees the management of all three funds.

The press release said that

“Final stop orders will be placed on the funds “if the ASIC’s concerns are not addressed promptly, Holon will have the opportunity to make submissions to ASIC before any final stop order is made.”