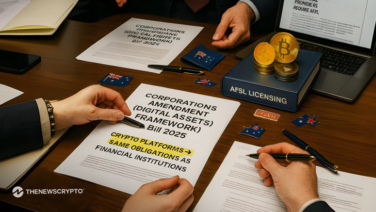

- Australian crypto exchanges and certain stablecoin issuers must obtain an AFSL to comply with financial service regulations.

- The Australian government is exploring solutions to the ongoing debanking issue, engaging with major banks to improve access for crypto firms.

Australia is about to overhaul its crypto regulations, which requires exchanges and stablecoin issuers to now obtain a financial services license. This is an initiative to tackle the debanking crisis affecting digital asset firms.

The proposed framework aligns with global regulatory trends, in a move to enhance consumer protection, market stability, and banking access for crypto businesses. This regulatory shift was publicly shared in a newly released policy paper by The Treasury department of the country. These reforms could significantly impact Australia’s crypto landscape, with potential implications ahead of the next federal election.

Crypto Exchanges and Stablecoins Faces Stricter Rules

This new trend is a mission to target crypto exchanges, custodians, and brokerages handling digital assets. These platforms must secure an AFSL and comply with financial service standards, including minimum capital requirements to prevent collapses like FTX in 2022. Exchanges must also ensure fair dealings, avoid conflicts of interest, and protect consumer assets.

Stablecoin issuers will be regulated as stored-value facilities, similar to non-cash payment systems. The Australian Prudential Regulation Authority (APRA) is expected to oversee stablecoin compliance, focusing on redemption rules and asset protections, though final regulatory details are still under discussion. However, secondary market trading of stablecoins and wrapped tokens won’t be classified as financial dealing, allowing exchanges to list them without additional licensing.

Startups and small-scale crypto firms may receive exemptions from full licensing, provided they meet tailored compliance measures. Non-financial blockchain developers and infrastructure providers will remain outside regulatory scope.

Government Takes on Debanking Crisis

Australia’s crypto sector has long suffered from debanking, where major banks deny services to crypto businesses. Authorities pledged to work with financial institutions, including Commonwealth Bank, Westpac, NAB, and HSBC Australia, to address the issue.

The reforms aim to restore trust between banks and crypto firms, potentially leading to greater banking access for digital asset platforms.

The government has pledged to explore tokenization, DeFi regulations, and crypto tax reporting standards, signaling a broader commitment to digital finance. While no new crypto-specific tax laws are planned, the Australian Tax Office (ATO) will form a working group to provide clearer guidance.

With draft legislation set for 2025, the upcoming federal election could impact the regulatory landscape. The opposition Coalition, led by Peter Dutton, has also pledged to prioritize crypto regulation if elected.

Highlighted Crypto News for Today

SEC Officially Acknowledges 21Shares Proposal for a Spot Polkadot ETF