- The decision on CBDC in Australia will take some time.

- The CBDC pilot program was structured as a legal claim on RBA.

Australia’s central bank has completed the pilot of the Central Bank Digital Currency (CBDC), researching the use cases for a potential digital dollar. The report revealed that Australia would not make any decisions on CBDCs for some years due to some unresolved issues that came up at the end of the pilot project.

We’ve released a report with the Digital Finance CRC @DigiFinanceCRC today on the findings from an Australian central bank digital currency pilot.https://t.co/bTT84yBp02#RBA #CBDC #Payments #DigitalPayments #Blockchain #FinTech pic.twitter.com/WXfe7lchHj

— Reserve Bank of Australia (@RBAInfo) August 23, 2023

On August 23, the Reserve Bank of Australia shared a 44-page report on the findings of the project. The report mentioned that many issues have yet to resolved. So the decision on it in Australia will take some time. Adding to that, the report mentioned that it would support financial innovations.

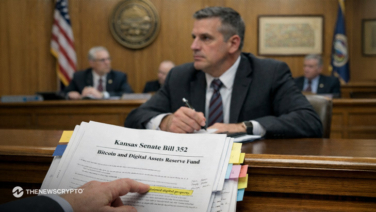

The Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centre (DFCRC) started the project last year. The project set up to research the opportunities of asset digitalization and its use cases in Australia. The CBDC pilot program structured as a legal claim on RBA rather than a proof of concept.

CBDC Expected to Increase Efficiency of Payment System

The pilot program revealed that four sectors could improved in the CBDC, which includes the enablement of smarter payments. It is a tokenized CBDC that enables a range of complex payment arrangements that are not supported by the current system. Moreover, the report focused on the need for further research due to the range of legal, technical, technological, and operational issues.

According to the report, cryptographic keys needed to perform actions on the pilot CBDC platform. However, finding cost-effective and supportively secure management was challenging for the firms that did not have the capabilities to operate on other DLT networks. Moreover, the project doesn’t provide a complete assessment of the cost, benefits, and potential risks of introducing it. Instead, it focused on the uses of CBDC in enhancing the functionality of the payment system.

The report has stated that its inclusion may increase efficiency and resilience in several sectors of the Australian payment ecosystem. However, more research needed to fully find out the potential benefits. So any decision on CBDC in Australia will take some years.