- One of his key goals of Fed is to reduce inflation to below two percent.

- She points out that the Fed has approved four straight rate rises of 75 basis points.

Ark Invest CEO and Chief Investment Officer Cathie Wood blame the Federal Reserve for deflation. To reduce inflation, the Federal Reserve is carrying out quantitative tightening. The Fed has effectively secured a worldwide stock market catastrophe with this move.

Catherine Wood of ARK investments, on the other hand, is skeptical of the Fed’s aggressive posture. She writes that the Fed’s policy advice will cause deflation in an open letter. Not just Wood has issued a grave deflation warning, but other prominent figures as well. Elon Musk, CEO of Tesla, has also voiced his displeasure with the central bank’s tight monetary policies.

Global Recession Warning

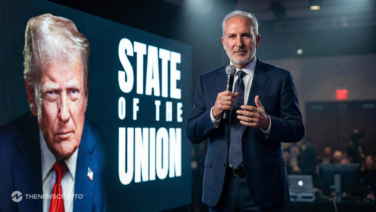

It would indicate that the Federal Reserve is determined to combat inflation. Jerome Powell, the head of the Federal Reserve, has stressed the need to rein down inflation before it becomes endemic. One of his key goals is to reduce inflation to below two percent. A lot of trouble was coming, he said, for families and companies.

The US currency has gained strength due to the Fed’s aggressive attitude. In other words, it has wreaked economic disaster in other nations. There will be a recession, according to comments provided by the World Bank and the United Nations to central banks. The US Federal Reserve is not expected to change course at this time.

As a result, Wood is skeptical of the Fed’s leadership. She points out that the Fed has approved four straight rate rises of 75 basis points each. In addition, she is worried by the Fed’s unanimous support for quantitative tightening. Members on both the liberal and hawkish sides have taken a strong position.

Recommended For You: