- Animoca Brands eyes global expansion despite SAND token scrutiny.

- SEC labels several tokens, including $SAND, as securities.

As the world shifts progressively towards the digital, Animoca Brands is looking beyond national confines. Significantly, the multinational technology company intends to expand its operations worldwide. Despite recent events regarding its SAND token, global ambition remains undeterred.

In a surprising twist, the SAND token has been dubbed unregistered security by the U.S. Securities and Exchange Commission (SEC). Consequently, this has presented the company with a new challenge to navigate. However, Animoca Brands, best known for its innovative play in the crypto and metaverse spaces, remains resilient.

The Trigger and Response

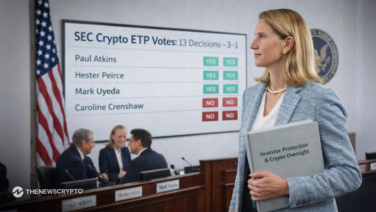

Recently, the SEC legally targeted large exchanges like Binance and Coinbase Global. Specifically, the watchdog labeled several tokens, including SAND, Solana, Polygon, and Mana, as securities. This move amplified the legal risks for firms tied to these tokens. Significantly, SAND is the crypto token for Animoca’s metaverse platform, The Sandbox.

Hence, Animoca Brands is shifting its emphasis to mitigate potential hurdles stemming from the SEC’s action. Moreover, it aims to navigate the perceived “blockchain-hostile” environment in the U.S. In response, Animoca is now making hefty investments in the Middle East and other regions worldwide to leverage burgeoning opportunities.

The SEC’s Token Classification Conundrum

Per sources, the SEC’s primary contention revolves around the purpose of a token. Specifically, whether it was used for fundraising and if investors anticipated investment returns. According to the SEC, Sand raised $3 million via private sales on Binance.com, leading holders to perceive Sand as a Sandbox protocol growth investment.

While these proceedings are underway, it doesn’t necessarily spell doom for the operators, states Pádraig Walsh, a partner at Tanner De Witt in Hong Kong. However, it does escalate the legal risk for U.S. firms.

In the wake of this news, SAND’s price stands at $0.483, marking a 1.77% decrease from yesterday. As the crypto space navigates this turbulence, the global market awaits the repercussions of these unprecedented regulatory steps.