- The price volatility of most crypto assets makes staking inappropriate for most clients.

- The Anchor liquidation pool is a higher-risk, higher-reward product.

Withdrawals may be made quickly, and depositors get a low-volatility interest rate of 19.5 percent, one of the highest among stablecoins. bLUNA and bETH may be used as collateral by borrowers to secure deposits at Anchor.

In a post published on February 17th, Anchor Protocol proposed a plan to replace ANC staking with vote-escrowed ANC (veANC). Tokens are held in escrow for a predetermined amount of time via vote escrow, pioneered by the curve.finance.

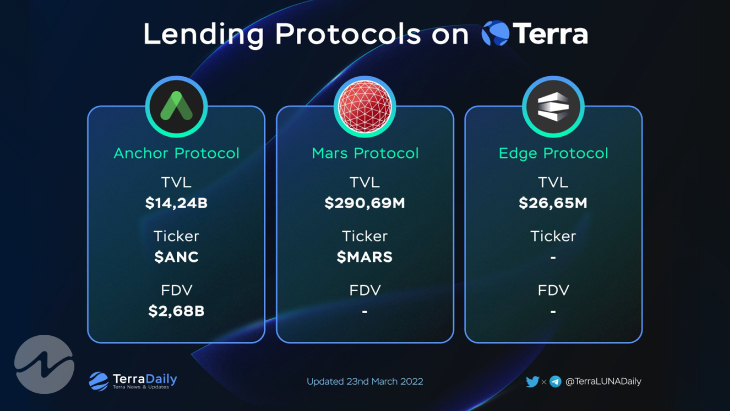

Lending Protocols Critical For Bringing TVL

The price volatility of most crypto assets makes staking inappropriate for most clients. For example, a home savings product cannot exploit the cyclical nature of stablecoin interest rates on DeFi mainstays like Maker and Compound.

One of the earliest protocols on Terra was developed to satisfy this pressing need: Anchor. It’s a way to save money by paying out a dividend based on the block rewards of popular Proof-of-Stake blockchains. In addition, customers who deposit money in Anchor’s principal-protected stablecoin savings product get a fixed interest rate. Deposit interest is regulated by giving block rewards to borrowed assets to lend stablecoins. Lending Protocols are critical to the success of bringing TVL to any ecosystem, as Terra recently said. On Terra, the platform has demonstrated its worth with the debut of Anchor Protocol, which accounts for 52% of Terra’s total TVL.

Lending Protocols on Terra

— Terra Daily 🌖 (@TerraLUNADaily) March 24, 2022

Lending Protocols are vital to the success of attracting TVL to every ecosystem. Since the launch of @anchor_protocol , the platform has proven its value as becoming the largest protocol accounted for 52% total TVL on Terra. $ANC $LUNA #Terra $UST pic.twitter.com/pqQ1LkRCqh

The Anchor liquidation pool is a higher-risk, higher-reward product that provides liquidation funds for Anchor debt holdings if customers do not wish to deposit or borrow. Authors of liquidation contracts may profit from both passive premiums and fees paid upon contract execution in the form of liquidation fees.