Introduction:

As a recent focus, the SEC approved 11 Bitcoin spot ETFs last week. UBS announced that it would allow certain clients to trade Bitcoin spot ETFs, and miner sell pressure reached its highest level since 2019 in the days leading up to the ETF approval. Additionally, Vitalik proposed to increase Ethereum’s gas limit by 33% to 40 million, and the Dencun upgrade is scheduled to go live on the Goerli testnet on January 17 at 14:32.

In terms of investment and financing, last week saw 22 global blockchain financing events, with a total capital scale exceeding $105 million. Moreover, the U.S. FINRA released its 2024 regulatory report, which includes a chapter on crypto assets for the first time.

This week’s investment research report from MIIX Capital not only provides data and analysis but also offers actionable insights, attempting to reveal the deep logic behind market trends to help you grasp the key to successful investing.

1. Key News Review

1.1 Hot Topics

- The SEC officially approves all 11 BTC spot ETFs.

- UBS to allow certain clients to trade BTC spot ETFs.

- Robinhood lists all 11 Bitcoin spot ETFs.

- Vitalik proposes to increase Ethereum’s gas limit by 33% to 40 million.

- Dencun upgrade is scheduled to go live on January 17 at 14:32 on the Goerli testnet.

- X removes support for NFT profile pictures.

- GameStop to shut down its NFT marketplace.

- OpenAI officially launches the online store GPT Store.

- Financing for AI-related Web3 projects in 2023 exceeds the total of the previous seven years.

- Fines in the crypto payment sector in 2023 surpass those in the traditional finance sector for the first time.

1.2 Investment and Financing Observations

Last week (1.8–1.14), there were 22 investment and financing events in the global blockchain sector, with a total capital scale exceeding $105 million. The overview is as follows

- 6 financing events announced in the DeFi track, including a $6.1 million seed round financing completed by DeFi lending service company Altitude;

- 5 financing events announced in the blockchain gaming track, among which the 3A gaming platform SkyArk Chronicles completed a $15 million financing round led by Binance Labs;

- 5 financing events in the infrastructure and tools track, including the Bitcoin Layer2 project Bitfinity raising $7 million with participation from Polychain Capital;

- 5 financing events announced for other Web3/crypto-related projects, with the Web3 music platform Tune.FM receiving a $20 million investment from LDA Capital;

- 1 financing event in the centralized finance domain, where the German crypto custody and staking service provider Finoa completed a $15 million strategic round led jointly by Maven 11 Capital and Balderton Capital; This week saw a significant increase in the number of investment and financing activities in the cryptocurrency market. In terms of sub-sectors, this week’s investment and financing were concentrated in the Web3 direction, but no significant active institutions were observed. In addition, OKX Ventures announced leading a new round of investment in the anti-hackathon platform BeWater, with the specific amount and other investors undisclosed; Quora CEO Adam D’Angelo announced receiving $75 million in financing from a16z to accelerate the development of the AI chat platform Poe.

1.3 Policy Dynamics

- The U.S. FINRA releases its 2024 regulatory report, including a chapter related to crypto assets for the first time;

- China’s Central Bank Shanghai Headquarters 2024 Work Conference: Prevent and deal with the risks of speculation in virtual currency transactions;

- Apple’s App Store in India removes several crypto exchange apps including Binance and Kraken;

- South Korea’s Financial Services Commission: Trading Bitcoin spot ETFs is illegal, and there is consideration for regulating crypto mixers.

2. Cryptomarket Data

2.1 On-Chain Data

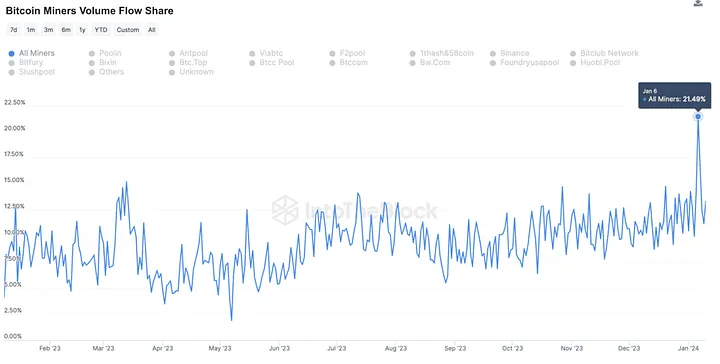

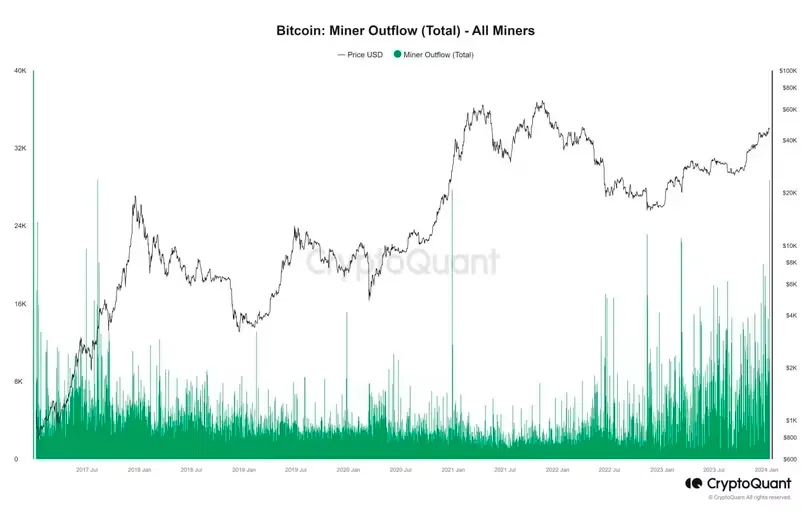

Miners Selling BTC in Large Quantities

In the days leading up to the ETF approval, the proportion of on-chain transactions by BTC miners reached its highest level since October 2019. Data from CryptoQuant shows that as BTC worth over $1 billion was sent to exchanges, the outflow of BTC held by miners reached a six-year high.

F2Pool analyst Bradley Park stated: The reason miners are selling BTC is due to the impending increase in costs. The move of F2Pool to Kazakhstan has led to increased mining costs, and the demand for upgrading to the Antminer T21 before the BTC halving has resulted in a significant outflow of BTC.

Tether’s market share has risen to 71%.

The Block’s data: USDT’s share of the global stablecoin supply has increased from 50% to 71%; As of now, the circulating supply of USDT exceeds 95 billion tokens, a number greater than the GDP of countries like Guatemala and Bulgaria.

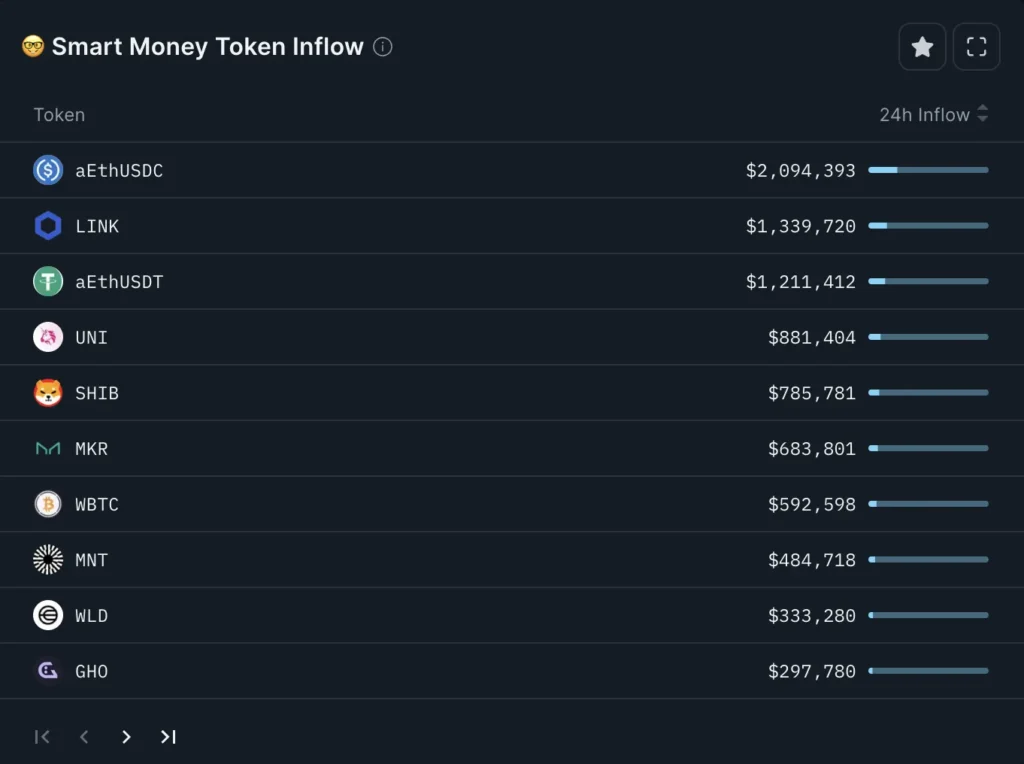

Smart Money is taking profits and increasing holdings.

In the past 24 hours, the top inflows into SmartMoney include stablecoins like USDC/USDT, LINK, UNI, SHIB, MKR, indicating that some SmartMoney has taken profits and converted into stablecoins.

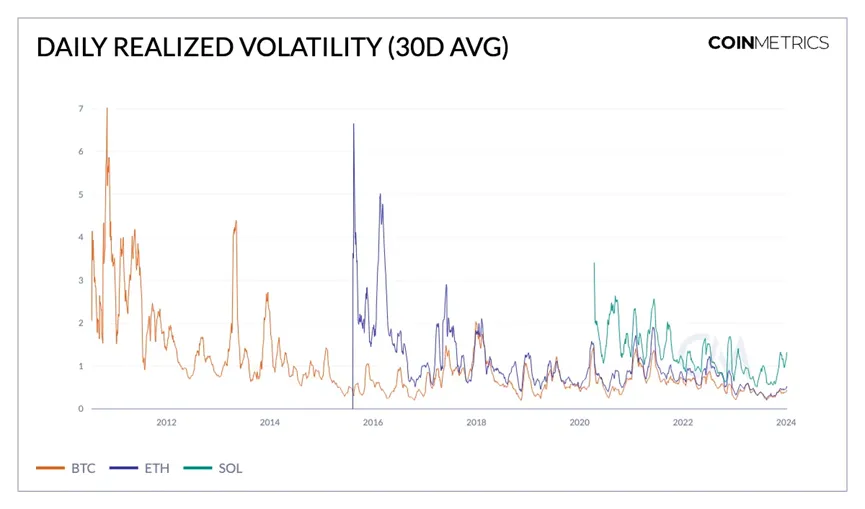

Volatility and Return Rate

As the pioneering and largest digital asset, Bitcoin has lower volatility compared to ETH and SOL, but it offers greater potential for returns than tech stocks, indicating that it is evolving into a mature yet growth-oriented asset. Its largely uncorrelated nature with traditional assets further highlights its value in diversified portfolios and enhances its attractiveness to investors seeking opportunities.

2.2 CEX Data

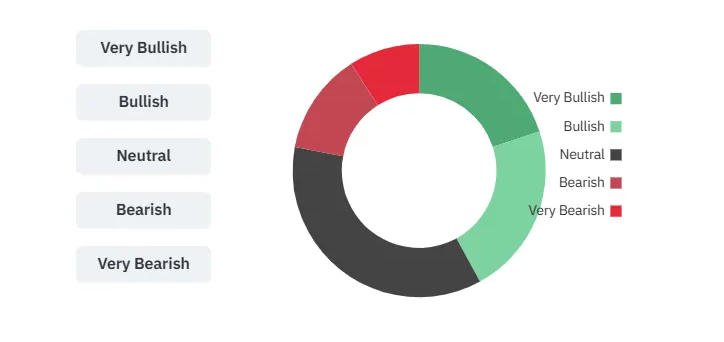

According to the Block data, in the past 24 hours, the long-to-short ratio has sharply risen to 2.86. Prior to the approval of multiple spot Bitcoin ETFs, the long-to-short ratio was at a low of 0.86. However, after the approval, this increase in the ratio may indicate that traders are predicting BTC to appreciate. Still, the sharp increase in the number of long positions implies a higher expectation of a potential decline in the market.

Currently, the sentiment towards Bitcoin on Coinglass leans bullish. In the past 24 hours, the distribution of long positions and short positions indicates that approximately 42% of traders are bullish on BTC, while only 22% are bearish, with traders maintaining a neutral stance.

2.3 DEX Data

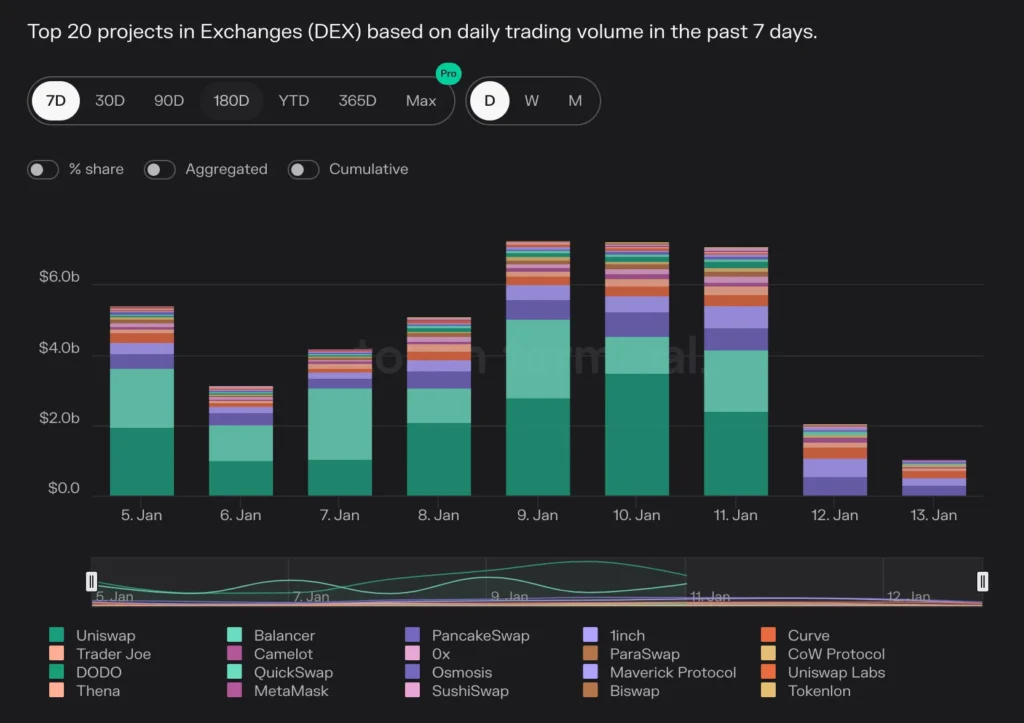

This week, the total circulating market capitalization of DEX is $12.61 billion, showing a 4.6% increase compared to the previous week. Here are the specific details:

- Uniswap continues to dominate the market with a 2.4% increase compared to the previous week, holding a 47.2% market share.

- In terms of trading volume and total fees, Uniswap has surpassed Balancer to claim the top spot with a 36.25% market share.

- Regarding 24-hour trading volume, 1inch holds the top position with a market share of 55.4% and a trading volume of $454.18 million.

- PancakeSwap leads in both 7-day total income (27.38% market share) and active users (30.71% market share).

- PancakeSwap also boasts the highest number of users, with a daily active user count of 509,910, representing 29.6% of the market.

- The Ethereum-based crypto wallet MetaMask remains dominant with a market share of 29.5%.

2.4 Market Focus

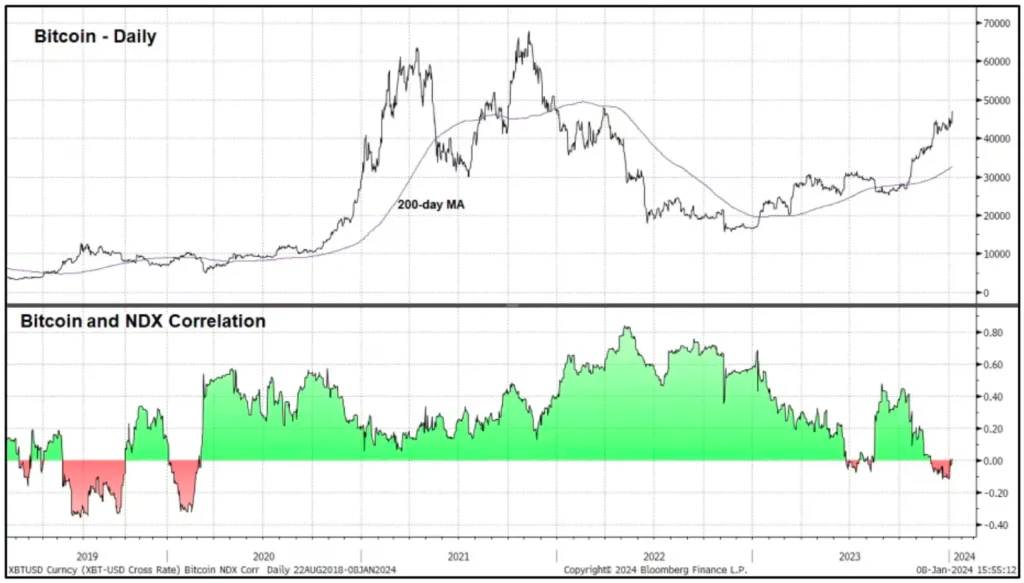

The correlation between BTC and NDX is 0

BTC has recently decoupled from the Nasdaq (NDX) index, ending the trend of moving in sync with Wall Street’s heavyweight stock indices that had been observed for most of the past.

According to Fairlead Strategies data, the 40-day correlation between Bitcoin and Nasdaq is zero, indicating a lack of correlation between these two asset classes. The collapse of correlation also suggests that Bitcoin can now serve as a diversification tool for portfolios, and it is expected that Bitcoin will remain unaffected by Nasdaq for some time.

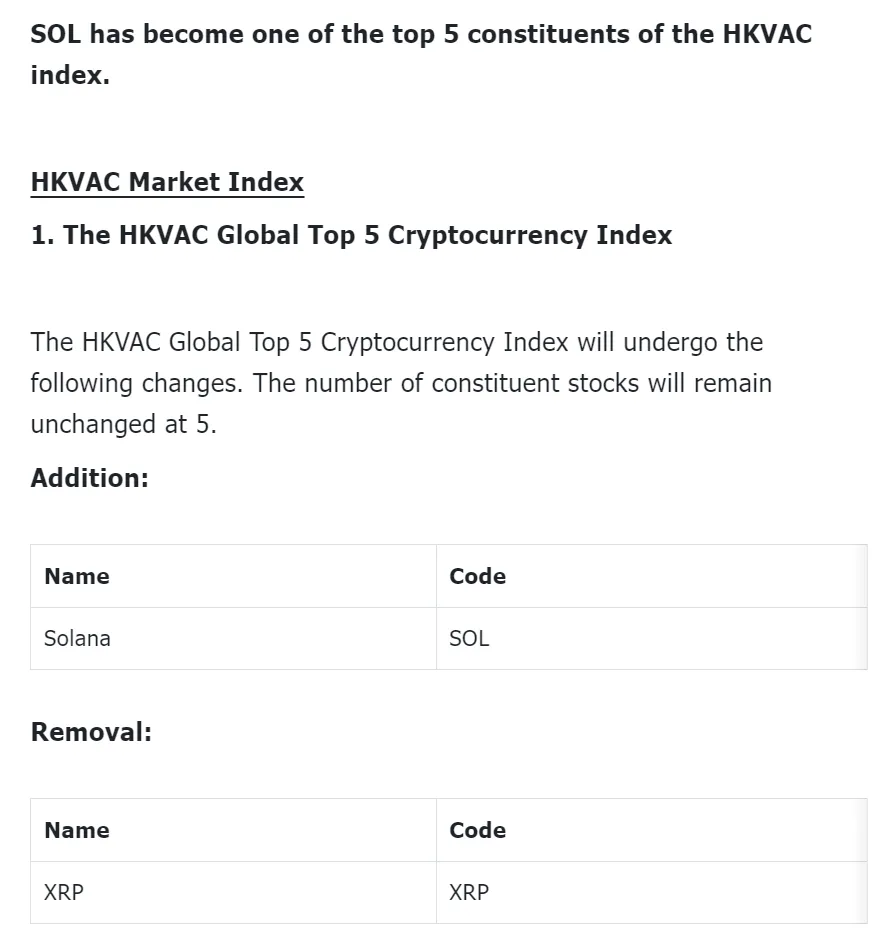

On January 14th, the Hong Kong Virtual Asset Classification (HKVAC) announced the index adjustments for the HKVAC Core Index and HKVAC Market Index:

- Solana (SOL) will replace Ripple (XRP) as part of the top 5 constituents in the global large-cap cryptocurrency index.

- Avalanche (AVAX) will replace TRON (TRX) as part of the top 10 constituents in the global large-cap cryptocurrency index.

All changes will take effect on January 19, 2023.

BTC may retrace to $38,000.

Since the approval of the BTC spot ETF by the SEC, BTC has fallen by more than 5%, displaying a typical “sell the news” price behavior. According to 10x Research analysis, this selling trend may continue in the short term. “Bitcoin’s RSI divergence signals an adjustment,” and the retracement may stop around the dynamic support level near $38,000.

When prices reach new highs but momentum indicators like the Relative Strength Index (RSI) fail to confirm, bearish divergence occurs.

Last week, BTC reached a two-year high, surpassing $49,000, but the 14-day RSI did not confirm it. The subsequent price decline validated the bearish divergence.

Additionally, the MACD histogram, used to measure trend strength and changes, has dropped below zero, indicating a bearish shift in momentum.

3. Trending Sectors

3.1 Re-staking

EigenLayer is a middleware protocol based on Ethereum that introduces the concept of re-staking. Re-staking allows Ethereum nodes to re-stake their staked ETH or LSD tokens into other oracles, bridges, or public chains, enabling them to enjoy Ethereum-level security at lower costs. Users can earn multiple rewards through this process.

Recently, there has been a trend in the market where liquidity staked in EigenLayer is converted into a new layer of liquidity tokens called LRT, leading to the emergence of re-staking liquidity games like LRTfi. Some noteworthy projects in this space include:

- Pendle ($PENDLE): An LSDFi protocol platform that is about to launch eETH, a liquidity staking token from ether.fi. Users can deposit eETH into Pendle’s LP to earn EigenLayer points, EtherFi points, and multiple staking rewards.

- Swell: An LSDFi protocol where users can stake ETH to earn Pearls and staking rewards. Swell is planning to introduce a re-staking feature for swETH, allowing users to stake ETH to receive rswETH, unlocking liquidity for ETH and additional rewards.

- Puffer Finance: A liquidity staking protocol based on EigenLayer that addresses forfeiture issues in both Ethereum and EigenLayer networks through its proprietary Secure-Signer tool and RAV technology. It aims to provide participants with low-risk double rewards and plans to launch its mainnet in 2024.

3.2 Modular Blockchain

Modular blockchains are specialized blockchains designed to perform specific functions, such as execution, consensus, settlement, or data availability, relying on other blockchains or services to perform the remaining tasks.

Modular blockchains address the performance bottlenecks of traditional monolithic chains by decoupling various functions and components of the blockchain. Each module is provided by specialized providers, offering the possibility of creating customized blockchains through a combination of these modules. This design enhances project security and allows project teams to focus on developing core features. Notable projects in the modular blockchain space include:

- Celestia: It employs an off-chain approach to achieve data availability, using Reed-Solomon erasure codes and a specialized Namespaced Merkle Trees structure to ensure cost-effective and efficient data availability. While Celestia has already launched its own token, users can indirectly participate in all modular projects using Celestia by staking tokens within their accounts.

- Manta: Manta is a modular blockchain for zero-knowledge (ZK) applications. It was the first to transition its data availability layer from the Ethereum mainnet to Celestia’s Layer2. Since this transition, transaction fees on Manta have decreased by 99.8%. Currently, Manta has a TVL exceeding $800 million, ranking just below OP and Arbitrum.

- AltLayer: AltLayer is a decentralized Rollup as a Service protocol with a modular design. End users can choose Rollups based on their requirements. Rollup SDKs support various options like Arbitrum Orbit and OP Stack. The data availability layer is compatible with Eigenlayer, Celestia, and Astria. AltLayer previously released the Ottie NFT series, which may receive token airdrops in the future.

- Cevmos: Cevmos is a collaboration between Cosmos EVM application chain Evmos and Celestia to develop a rollup stack. It aims to be the best settlement layer for EVM rollups built on Celestia. The name ‘Cevmos’ is derived from Celestia, Evmos, and Cosmos.

4. Recommended Projects to Follow

4.1 ZKFair

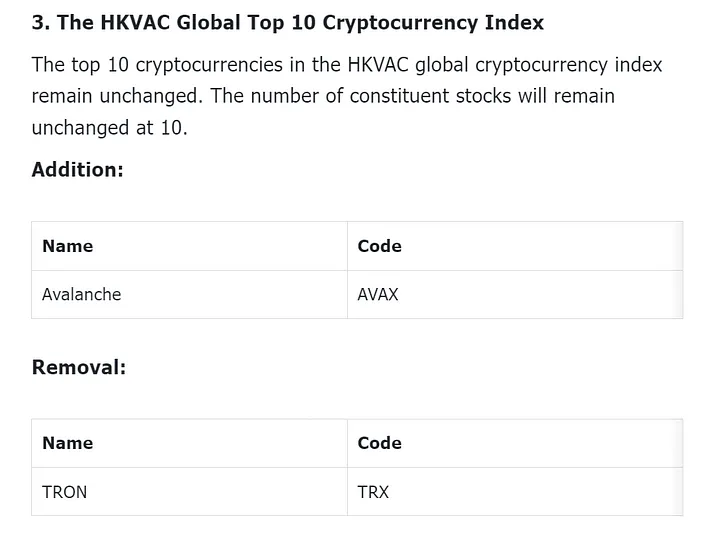

L2beat data: The first community-driven ZK L2 network, ZKFair, has achieved a new all-time high in on-chain Total Value Locked (TVL), with the current TVL standing at $132 million. In the past 24 hours, it has witnessed a staggering 109% increase in TVL, securing its position as the 12th highest-ranked L2 solution.

ZKFair adopts a 100% fair launch token model and receives technical and computational support from the ZK-RaaS platform Lumoz. ZKFair utilizes USDC as the Gas token. Upon its mainnet launch, the TVL skyrocketed to $124 million within six days. Currently, ZKFair’s native token, ZKF, is listed on more than 10 exchanges, including Bybit, Gate, Bitget, Kucoin, and others. Additionally, ZKFair has introduced the ZKF staking mechanism, allowing users to stake ZKF tokens and receive a share of the Gas fee profits generated on the ZKFair network.

The staking feature was officially launched on January 10th. To ensure fair participation, users could only perform Staking operations until January 15th. After this date, Gas fee profits will be distributed based on the proportion of staked tokens, with 75% going to users and the remaining 25% allocated to Dapp developers. As of the time of writing, the total amount of ZKF staked has surpassed 1 billion tokens.

4.2 Berachain

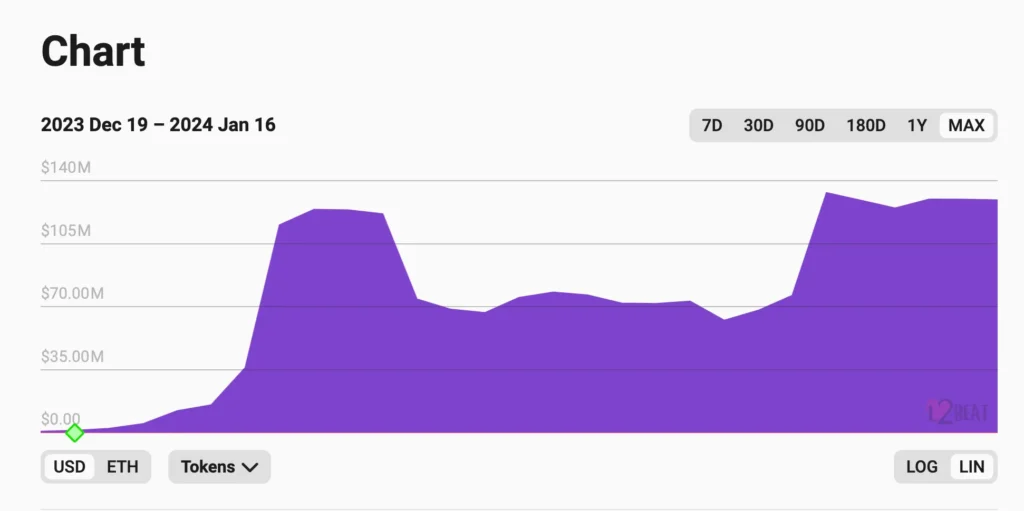

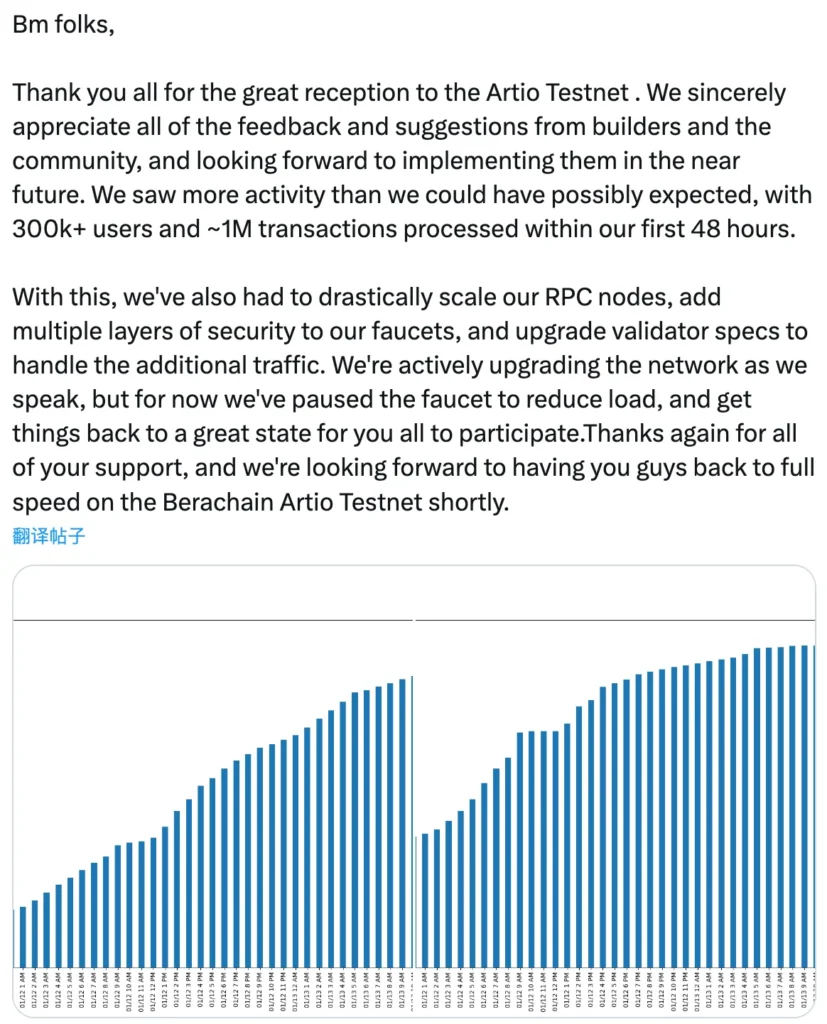

On January 11th, the Layer1 public blockchain Berachain launched a public testnet called Artio. The Berachain network is built on the Cosmos SDK and will be EVM compatible. Last year in April, Berachain completed a $42 million funding round led by Polychain Capital.

Berachain introduces the concept of “liquidity proof” consensus aimed at aligning incentives between security and liquidity. According to a statement, Berachain’s previous private testnet was hosted under confidentiality agreements with multiple partners, and approximately 50 teams deployed contracts within a month.

When it is finally released later this year, Berachain is expected to receive support from custodians, cross-chain messaging and bridging protocols, and data availability solutions. The mainnet for Berachain is planned to launch in the second quarter of this year.

Berachain has stated that there are currently more than 30 local teams building on Berachain, and over 100 teams from other networks are planning to deploy on the testnet and mainnet, including well-known brands like Pendle, Redacted, Sudoswap, Abracadabra, and others.

5. Focus on Narratives

Standard Chartered predicts BTC price

Standard Chartered Bank has stated that after the approval of Bitcoin spot ETFs in 2024, the inflow of funds may range from 50 to 100 billion USD. By the end of 2025, the price of Bitcoin may reach 200,000 USD per unit.

U.S. House of Representatives Optimistic About ETFs

U.S. Representatives Patrick McHenry and French Hill have stated that the approval of Bitcoin spot ETFs marks a historic milestone for the future of the U.S. digital asset ecosystem. While legislation for digital assets still requires clarity and certainty, the actions taken today represent a significant improvement in SEC enforcement and oversight.

SEC Discusses Bitcoin ETF

SEC Chairman Gary Gensler released a statement: While we have approved the listing and trading of certain Bitcoin spot ETP shares today, we have not approved or endorsed Bitcoin, and investors should exercise caution regarding the risks associated with Bitcoin and cryptocurrency-related products.

Bloomberg Predicts Ethereum ETF

Bloomberg ETF analyst Eric Balchunas: There is a 70% chance that an ETH spot ETF will be approved in May.

Fidelity Bullish on DeFi Yield Recovery

Fidelity stated in its 2024 Digital Asset Outlook report: If DeFi yields ‘become more attractive than traditional finance (TradFi) yields again, and more developed infrastructure emerges’, institutions may show ‘new interest’ in DeFi in 2024.

SINOHOPE to Deeply Engage in BTC Ecosystem

SINOHOPE CEO Jun Du stated: Prepared to deeply engage in the Bitcoin ecosystem, focusing on the Layer2 track, with $50 million in funds prepared and a publicized address dedicated to the project’s development.

Cathie Wood Bets on BTC

Ark Invest CEO Cathie Wood mentioned: Excluding companies and real estate, it is estimated that at least 25% of financial net assets are in Bitcoin.

Akash Founder Bullish on Cosmos

Akash founder Greg Osuri posted on social media: Among the top 100 cryptocurrencies in the crypto market, 10% of projects are built using Cosmos SDK, compared to 6% a year ago.

6. This Week’s Focus

January 16th

- The BRC20 cross-chain protocol Shell Trade launches its IDO, offering a total of 650 million tokens for sale;

- The cross-chain trading infrastructure zkLink will conduct a community token sale on CoinList, with the whitelist application closing today;

- Manta Network’s public chain liquidity incentive event, New Paradigm, closes the deposit window.

January 17th

- U.S. retail sales monthly rate for December;

- The New York financial regulatory authority has approved Paxos’s expansion to Solana, which plans to launch today;

- The Dencun network upgrade is scheduled to be activated on the Goerli testnet at 14:32 Beijing time;

- ApeCoin (APE) will unlock approximately 15.6 million tokens at 8 a.m., valued at about $22.3 million;

- The NFT platform Metaplex on Solana is fully on-chain on Solana with its inscriptions.

January 18th

- Number of initial jobless claims in the United States;

- Axie Infinity (AXS) will unlock approximately 3.43 million tokens at 9:10 PM, valued at about $27 million;

- Bakery Launchpad launches its first free project OpenSky, with the Launchpad starting at 4 PM;

- Euler (EUL) will unlock 110,000 tokens at 8 AM, valued at about $450,000.

January 19th

- CoinList will start the sale of Subsquid tokens at 2 AM, with registration already open;

- The adjustment of the HKVAC crypto index will take effect starting today.

January 20th

- The modular blockchain Dymension Genesis Drop from the Cosmos ecosystem will close applications at 8 PM;

- The Web3 social and speculative platform Socrates.com launches its first community airdrop;

- Injective (INJ) will unlock approximately 3.67 million tokens at 8 AM, valued at about $133 million.

7. Summary

Over the past week, we have witnessed a historic moment in the crypto world: the SEC officially approved all 11 Bitcoin spot ETFs, a decision akin to Washington’s determined crossing of the Delaware River on a cold winter night, a move made after careful consideration and without regrets. The market dynamics, such as miners’ sell pressure, smart money taking profits, and the relationship between Bitcoin’s volatility and returns, are all making their moves on this chessboard.

The rising ratio of long and short Bitcoin contracts on the Binance trading platform seems to foreshadow greater market turbulence; however, the disappearance of the correlation between BTC and NDX suggests an unusual calm. These indicators signify Bitcoin’s uniqueness as a diversified investment tool in the broader financial market, which is a significant positive for the industry.

Additionally, SOL has become one of the top five index members of HKVAC, SINOHOPE plans to deeply engage in the BTC ecosystem, and trends like re-pledging businesses and modular blockchain are gradually entering public view. These strategies and evolutionary trends seem to suggest that the entire industry is accelerating its pace, constantly innovating from within to stimulate and create vitality, bringing new experiences and services to the market and users.

With the launch of the Bitcoin spot ETF, the market has shown a retracement trend, and whether it will pull back to $38,000 remains a mystery. In this volatile and unpredictable crypto market, every participant, like Washington back then, bears the risks of their decisions. But just as his decision changed the course of history, our choices today may well be the key steps in ushering in a new era.

Note: All of the above opinions are not investment advice. If there are any inappropriate points, please feel free to leave a message to supplement or correct them.

Join the MIIX Capital community to learn more about cutting-edge information~

Twitter EN: https://twitter.com/MIIXCapital

Telegram EN: https://t.me/MIIXCapitalEN