Are the dramatic rise and consecutive demise of bullish rallies of assets in the stock market or the highly volatile crypto market normal? Do they indicate any specific economic phenomenon? Have these questions ever popped into your mind?

Here are the answers – No, it is not normal to observe such cycles in either of the markets and yes, it indicates a specific phenomenon. In the economic lexicon, “Bubbles” are these dramatic financial cycles.

In general, bubbles in any economic market refer to the cycle when the asset’s price spikes up to extreme peaks, irrespective of its intrinsic value, merely due to investors’ hype and sharply plunge to its extreme bottom.

What is the root cause behind the bubbles forming in the financial markets? Significantly, speculation and hype are the primary initiators and drivers of economic bubbles – stock or crypto. But the stock and crypto bubbles cannot be equated with each other. Circumstances in both markets do not come in tandem, an exception is the 2022 bear market.

What are Crypto Bubbles?

When a cryptocurrency gets trapped in a bubble cycle, it observes the following three concurrent events – price inflation irrespective of its intrinsic value, soaring hype and speculations, and low adoption in the real or off-chain economy.

The protagonist of any crypto bubble is a crypto asset that succeeded in triggering unreal hype among investors by portraying itself as a burgeoning income cum investment opportunity. In short, crypto bubbles are speculative episodes of the cryptocurrency’s extreme price inflation with a sharp decline as a follow-up.

Gist of What Happens During a Bubble

Noted economist Hyman P. Minsky outlined five stages of a bubble (similar to that of a credit cycle) – displacement, boom, euphoria, profit-taking, and panic. Firstly, the scenario when investors buy into the trend of opting for the asset – that presents itself as a fascinating investment option – represents the displacement phase. Word-of-mouth accelerates progress.

Initially, the asset’s price begins to gradually rise and when many investors flock in, the surge begins. Literally, the price booms, surpassing newer resistance levels. Eventually, the asset hits the headlines boosted by the community’s hype. This stage is interpreted as the boom phase.

Following this, the euphoria phase slides into the picture when the asset’s prices inflate to unimaginable levels. Traders at this phase disregard every kind of disbelief/caution and only prioritize driving the hype and FOMO. The next two phases are quite crucial for a bubble. The warnings and sell pressure signals begin to knock in during the profit-taking phase. Traders’ fantasies are shattered down.

The thought that a bubble can never stay unpricked is pinned high up. This phase typically warns investors about the possible bubble burst and urges them to sell their assets to take up profits. Lastly, the final stage – the panic phase is characterized when the fear of the bubble being pricked heightens to its peak. Conversely, the asset’s price halts inflation and switches to rapid decline. It is confirmed that the asset’s price cannot inflate until the next bubble.

A History Check

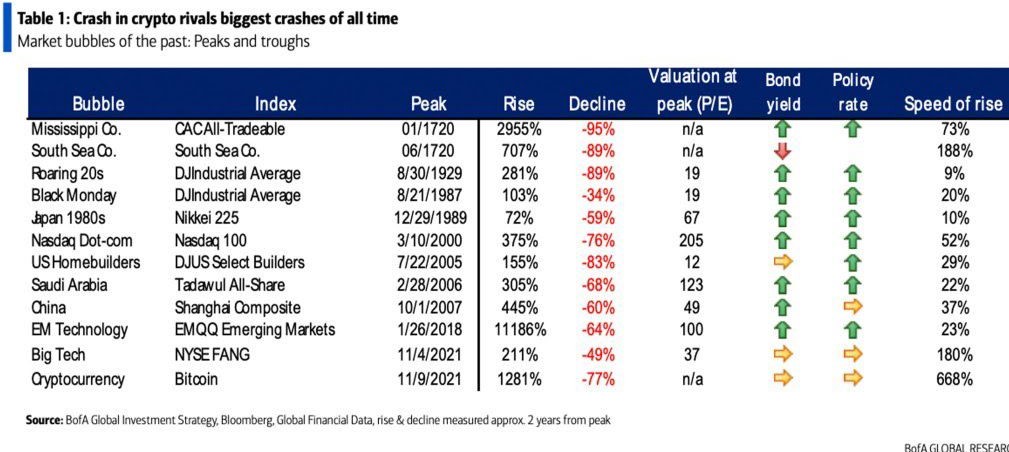

Before exploring the bubbles of the highly volatile crypto market, let’s do a quick recap of the historical TradeFi bubbles.

The off-chain traditional finance (TradeFi) market recorded notable bubbles in its historical archives. To highlight the pioneering records – the Tulip Bubble in the 1630s, the Mississippi Bubble and the South Sea Bubble in 1720, and then Japan’s Real Estate and Stock Market Bubble in the 1980s. During the 1990s, it witnessed the two famed US-origin bubbles – the Nasdaq Dotcom Bubble and the US Housing Bubble. The former was led by the investors’ speculations about the US tech companies’ stocks. This bubble then burst out in 2002 by recording nearly a 78% plunge. While the latter was led by the investors’ hype towards the US real estate stocks regarding them as safe assets.

The Bitcoin Bubble – Major Crypto Bubbles

Nouriel Roubini, a famed economist, called out Bitcoin as the “biggest bubble in human history” and “mother of all bubbles.” This pioneer cryptocurrency showed numerous sequels of bubbles. In the archive, we have four cycles – 2011, 2013, 2017, and 2021.

| BITCOIN BUBBLES | BUBBLE PERIOD | BUBBLE PEAK | BUBBLE BOTTOM |

| Bitcoin Bubble 1 (2011) | June – November 2011 | $29.64 | $2.05 |

| Bitcoin Bubble 2 (2013) | November 2013 – January 2015 | $1,152 | $211 |

| Bitcoin Bubble 3 (2017) | December 2017 – December 2018 | $19,475 | $3,244 |

| Bitcoin Bubble 4 (2021) | September 2021 – ? | $68,789 | $15,599 (till now) |

How crypto bubble identified?

The correlation between the asset’s ongoing price movements in the market and its intrinsic value is the base criterion for detecting a financial bubble. Markedly, an asset is said to be in a bubble when its price inflation shares no relation with its principal value.

A myriad of metrics is at traders’ disposal but predicting a crypto bubble in advance using these is not a cakewalk. Interestingly, the Fear and Greed Index is also another indicator that aids in analyzing Bitcoin’s market sentiment.

Out of those, one specific metric swayed the crypto investors’ attention and that is – Mayer Multiple. Trace Mayer – a renowned crypto investor and host of “The Bitcoin Knowledge Podcast” formulated this metric. This latest metric value is derived as the result of the current Bitcoin (BTC) price over the 200 moving average (EMA).

Mayer Multiple = Bitcoin market price / 200-day MA value

Two levels, 1 and 2.4, are this indicator’s checkmarks. When the price of BTC exceeds the threshold of 2.4, it indicates the start or occurrence of a bitcoin bubble.

During all the historic Bitcoin bubbles – 2011, 2013, 2017, and 2021, BTC price had surpassed and marked its peaks above the threshold 2.4. At these MM peaks, Bitcoin (BTC) recorded its ATH of the corresponding cycle. Thus, MM can be regarded as potential litmus to identify a bubble.

Conclusion

Initially, many a time, cryptocurrencies were criticized and remarked on as hype-driven assets exhibiting numerous bubble cycles. The highly volatile market’s risks and wavering trends have not entirely convinced the off-chain people in trusting these digital innovations. Fortunately, viewpoints of the world toward crypto are evolving in the present day.

Significantly, cryptocurrency adoption has accelerated now. Bitcoin continues to prove itself as a worthy ‘store of value’ that aids financial inclusion, and hassle-free cross-border payments and eradicates corruption caused by centralized entities. Bitcoin as a legal tender in countries and altcoins as a payment mode in the real economy indicate that people have begun acknowledging the pros of cryptocurrencies and their values.