- Hyperliquid jumped by over 22%, trading at $37.

- HYPE’s daily trading volume has soared by 33%.

As an escape from yesterday’s red trap, today, the crypto market is witnessing a 2.27% rebound. The digital tokens are charted in green, with the largest assets like Bitcoin (BTC) and Ethereum (ETH) seeking the upward wind to blow heavily to reclaim their recent highs. At the same time, Hyperliquid (HYPE) has jumped over 22.22% in just 24 hours.

The opening price of the asset was at around a low of $29.96, and with the gradual push of the bulls, the Hyperliquid price has recovered from the bear trap and climbed to a high of $38.30. Some of the crucial resistance levels between $30 and $37 have been tested and broken to confirm the bullish trend within the HYPE market.

At press time, Hyperliquid traded at the $37.15 zone, with a market cap of $11.20 billion. Besides, the asset’s daily trading volume has increased by over 33.87%, reaching the $982.40 million mark. The Coinglass data has reported that the market has experienced a 24-hour liquidation of $34.14 million worth of HYPE.

Upon the current upside pattern of Hyperliquid continuing, the price could move up to the resistance at around $37.35. If the bullish pressure strengthens, the golden cross might unfold, sending the price above $37.56. Assuming the asset reverses the momentum bearish, the Hyperliquid price could slip and find the nearest support at $36.95. A potential downside correction would drive the price below $36.74, along with the emergence of the death cross.

Technical Indicators Hint at Uptrend for Hyperliquid

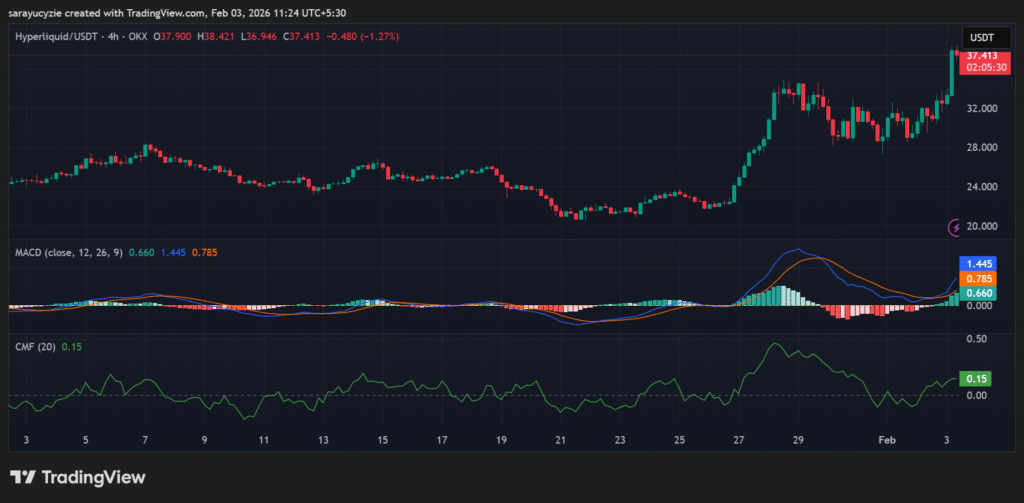

The 4-hour technical analysis of Hyperliquid shows that the Moving Average Convergence Divergence line is above the signal line, indicating bullish momentum. The short-term trend is stronger than the long-term, and if the MACD continues to rise, a potential upside can be seen.

In addition, the Chaikin Money Flow (CMF) indicator found at 0.15 suggests moderate buying pressure in the HYPE market. With this value, the buyers are in control, but the current strength is not extremely high. Also, the money is steadily flowing into the asset.

Hyperliquid’s daily Relative Strength Index (RSI) at 68.73 implies that it is approaching the overbought territory. The market is strongly bullish, but caution is warranted, and the buyers are dominant, but the ongoing momentum may slow down soon.

Moreover, the Bull Bear Power (BBP) reading of HYPE at 9.119 signals strong bullish dominance. Notably, the buyers are significantly stronger than the sellers, likely displaying that the momentum supports further price increases in the short term.

Top Updated Crypto News