For any trader, recognizing stock chart patterns is essential to continued success and profitability. However, the process can be time-consuming and challenging, as patterns can look identical and often require a trained eye to distinguish one from the other. Stock chart patterns, which are graphical representations of price movements in the stock market, are used by traders to identify potential trends and make predictions about future movements.

When you consider that Timothy Sykes, one of the big names in trading penny stocks today, has taught how to observe stock chart patterns to his top students— some of whom have now made several millions of dollars over a few years— you get an idea of just how much profit can be made from understanding stock chart patterns.

Every trader knows stock chart patterns are essential, either in part or in full, but not all traders understand the immense value of finding these patterns in real-time. Experienced traders are now leveraging the power of artificial intelligence (AI) to see patterns in real-time and make more informed trading decisions. The good news is that any trader, no matter how inexperienced, can also do the same when guided properly.

In this article, I will show you the benefits of finding stock chart patterns in real-time and how to leverage AI for the best ROI. But first, let’s see the most important stock chart patterns to look for.

Which Stock Patterns Are The Most Important?

According to Sergey Savastiouk— founder and CEO of web-based, interactive financial marketplace Tickeron— the concept of stock chart patterns is based on the idea that certain patterns tend to repeat themselves and thus can be used to anticipate market movements.

There are many stock patterns that could come in handy and if you are going to trade stocks more easily, you should be aiming at knowing, recognizing, and understanding the most important of them. Wondering what the most essential stock patterns are? Financial technology thought leader Savastiouk has some answers:

1. Head and Shoulders: This pattern is often a signal that a security’s price is set to fall, once the pattern is complete. It consists of a peak (head), followed by a higher peak (shoulder), and followed by a lower peak (shoulder).

2. Cup and Handle: This bullish signal marks a time of consolidation before a breakout. It resembles a teacup when viewed from the side.

3. Double Tops and Bottoms: This pattern often signifies a trend reversal. Double tops are formed after a sustained uptrend and signify that the asset is set to fall. Double bottoms, on the other hand, are formed after a sustained downtrend and signify a potential rise in the asset’s price.

4. Triangles: These can be ascending, descending, or symmetrical, and often signal the continuation of a trend. They are typically identified by drawing trendlines along the highs and lows on a chart and noting the convergence.

5. Flags and Pennants: These short-term continuation patterns mark a small consolidation before the previous move resumes.

6. Wedges: Wedges can be either rising or falling and can signify both reversal or continuation patterns, depending on the trend on which the wedge forms.

While there are many more patterns that can influence or impact trading, Savastiouk notes that the patterns above are the most critical weapons in a trader’s arsenal. The patterns serve as a guide for traders and investors, providing them with insights into potential price movements. However, as with all trading strategies, Savastiouk says they should not be used in isolation but in conjunction with other indicators and risk management techniques.

The Dawn of AI Trading Bots

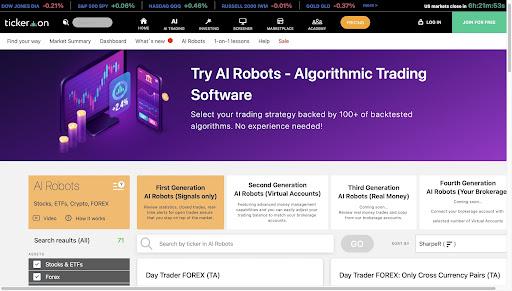

AI and automated trading systems, often referred to as trading robots or “bots,” have become increasingly common in today’s financial markets. AI-powered platforms like Tickeron might help professional traders find stock patterns by enabling pattern recognition, backtesting, automated alerts, predictive analysis, and integration with other tools. AI trading bots can further benefit professional traders in the following ways:

- Efficiency: AI robots can process vast amounts of data at a speed far beyond human capabilities. They can analyze market trends, identify patterns, and execute trades in real-time, increasing efficiency and responsiveness.

- Emotionless Trading: AI robots are devoid of emotions, which can often negatively impact trading decisions. They strictly follow the trading strategy they are programmed with, eliminating the risk of panic selling, overconfidence, or other emotional decisions.

- 24/7 Trading: Financial markets, especially cryptocurrency markets, operate around the clock. AI robots can trade continuously, capitalizing on opportunities that might arise outside of a human trader’s working hours.

- Customizability: Traders can program AI robots to follow specific strategies that suit their risk tolerance, financial goals, and preferred markets.

However, while AI trading bots offer a range of benefits, they also pose some risks— including overreliance, cybersecurity risks, and inability to adapt to market volatily. That’s why Savastiouk notes that they should be used as part of a broader investment strategy that considers a variety of factors. For example, the AI-powered trading platform Tickeron has other tools like AI Screener to perform a thorough fundamental analysis. Tickeron also incorporates risk management strategies, such as stop-loss and take-profit orders, in its AI robot to help manage market volatility risks.

While AI robots have their place in trading, offering potential benefits in terms of efficiency, emotionless trading, and the ability to operate 24/7, Savastiouk advocates that they should be used wisely, with awareness and mitigation of the associated risks.

Benefits of Finding Stock Patterns in Real Time

As a stock trader, you can move from seeing patterns after they happen to see them as they happen. The benefits of finding stock patterns in real-time are enormous and Savastiouk shares some insights below:

Timely Decision-Making: Stock markets are volatile, with prices moving rapidly in response to a multitude of factors. Identifying patterns in real time enables traders to make timely decisions, seizing opportunities as they arise and potentially improving their returns.

Risk Management: Real-time pattern recognition can alert traders to potential price reversals or continued trends. This allows for better risk management as traders can set stop-loss orders or exit positions based on emerging patterns.

Automation and Efficiency: Real-time pattern recognition, especially when done through AI platforms, can significantly increase efficiency. It eliminates the need for manual chart analysis, allowing traders to monitor multiple securities simultaneously and freeing time to focus on strategy development.

Confirmation of Trade Signals: Real-time pattern recognition can be used to confirm signals from other indicators or forms of analysis. If a pattern aligns with a signal from another technical indicator, it can give traders more confidence in their decision.

Improved Precision: Real-time pattern detection can help pinpoint exact entry and exit points for trades. By identifying the exact moment a pattern completes or a breakout occurs, traders can enter or exit trades at the most advantageous moment.’

Adaptability: Markets are constantly changing, and what worked yesterday might not work today. Real-time pattern recognition helps traders stay adaptable, providing up-to-the-minute information that reflects the current market conditions.

Tickeron’s Evolution and Roadmap:

Tickeron has been at the forefront of AI-driven trading tools, consistently evolving its offerings to enhance user experiences. Their innovative approach is organized into four distinct stages of development, aimed at meeting the diverse needs of their clientele.

In the initial stage, Tickeron introduced a comprehensive suite of AI Engines, including the Pattern Search Engine (PSE) for Technical Analysis, AI Stock Trend Prediction Engine (TPE) for Technical Analysis, Real-Time Patterns (RTP) for Technical Analysis, Buy/Sell Daily Signals for Technical Analysis, and the Advanced Stock Screener for Fundamental Analysis. Responding to user demand for practical applications in stock trading, Tickeron introduced AI Robots, marking the inception of their Four Generation roadmap.

Currently, Tickeron stands at the forefront of the Third Generation of AI Robot development. The First Generation, which provides signals, has been operational for several years, allowing users to manually replicate trades from AI Robots (Signals only) to their brokerage accounts for real trades. The Second Generation, Virtual Accounts (VAs), recently made its debut, enabling users to manually copy trades from VAs to their brokerage accounts for seamless execution.

Final Thoughts

While AI-powered bots offer huge benefits and can help traders make data-driven and insights-backed decisions, the stock market must always be approached with caution. As experts like Savastiouk advise, it’s important to note that real-time pattern recognition should be used in conjunction with other forms of analysis and tools (which Tickeron offers). All trading strategies carry risk, and a comprehensive approach can help to manage this. Additionally, pattern recognition requires significant skill and understanding to interpret correctly and is not a guarantee of future price movements.