- This network uses a hybrid proof-of-stake.

- Solana was listed on Coinbase Pro earlier this month.

Solana, one of the year’s best-performing cryptocurrencies, has become a popular subject among crypto fans. Year-to-date, the asset has increased by almost 15,000 percent.

Investors are intrigued by Solana for several reasons. Investors are very interested in the cryptocurrency’s success this year. This newly-minted “top 10” cryptocurrency’s market cap has surged. Investors will pay close attention to any asset that increases from under $1 billion to over $70 billion in a few months.

Many reasons exist for investors to examine Solana right now. Nonetheless, these three reasons are key to comprehending Solana’s tale.

1. Solana’s Mining Strategy

The increasing focus on energy use associated with proof-of-work mining for cryptocurrencies like Bitcoin has prompted some investors to seek more eco-friendly cryptocurrencies. Proof-of-stake models, like Solana, have outperformed. This is not a coincidence.

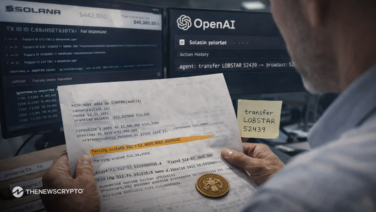

But Solana’s blockchain innovation is really special. This network uses a hybrid proof-of-stake and proof-of-history consensus process. This implies that transactions are executed in sequence, first-in-first-out. This reduces network transaction times and keeps costs low (around $0.01 per transaction).

2. Spike in NFT Interest with Solana

Solana’s high-powered platform has demonstrated a remarkable capacity to promote innovation in a variety of ways. Investors are interested in the simplicity of online shopping with Solana. Unlike other large-cap crypto coins, this one has some compelling real-world application cases.

The non-fungible token (NFT) market is one of Solana’s recent hot topics. NFT investors may purchase and sell popular NFTs on the Solana network’s Solonart marketplace.

3. Solana Has Wide Market Acceptance

As with other cryptocurrencies, wide adoption by exchanges and crypto funds has fueled interest among ordinary investors. This seems to be the case with Solana.

Solana was listed on Coinbase Pro earlier this month. It’s a significant thing to be listed on a major exchange like Coinbase. These exchanges attract a larger range of investors. Solana’s increased liquidity has created a “Coinbase impact” for freshly listed coins. Crypto researcher Messari claims that tokens listed on Coinbase gain an average of 91% in the five days after their placement.

Recommended for You

- Indian PM-Modi Opens Up on Crypto in an Assertive Stance

- Charles Hoskinson Speaks up on The US Crypto Infrastructure Bill

- Polygon (MATIC) Price Expected to Rebound After the Recent Slump

- Avalanche Ecosystem’s Top 3 Gainers in the Last 7 Days as Per CryptoRank.io

- Whale Alert- 50,000,000 TRX (5,304,874 USD) Transferred to an Unknown Wallet