- Solana is hovering around $141, posting a loss of over 10%.

- The SOL market has recorded $69.33 million in liquidations.

The sturdy bears in the crypto market have shaken the assets by a 5.62% pullback, bringing the market cap down to $3.28 trillion. All the major digital assets have been charted in red, losing their recent gains. Bitcoin (BTC) has dropped below the $100K, trading at $97.2K. Meanwhile, Ethereum (ETH) is hovering at 43.1K. Among the altcoins, Solana (SOL) suffered a hard hit, plunging by over 10.04%.

Significantly, VanEck has filed a Form 8-A with the SEC for its Solana spot ETF, a move that comes right before the launch. Will this push SOL toward its next major breakout? In the early hours, the asset attempted to clear the $160 zone and ended up trading at around $156.99. With the potential bears stepping in, the Solana price slipped to a bottom range of $139.87.

At the time of writing, Solana trades within the $141.34 mark, with its market cap staying at $78.07 billion. Consequently, the daily trading volume has increased by over 26.16%, having reached the $7.85 billion zone. In addition, the market has experienced a liquidation of $69.33 million during the last 24 hours, according to the Coinglass data.

Will Solana’s Slide Continue, or Is a Rebound Near?

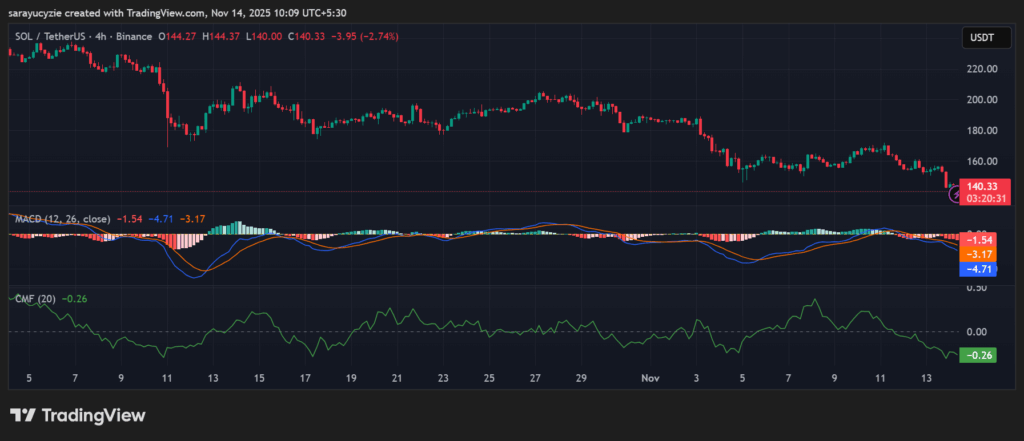

Solana’s technical analysis exhibits that the Moving Average Convergence Divergence (MACD) is below the signal line. It indicates weakening momentum and a bearish bias. As both lines are positioned below the zero line, the overall trend is negative. SOL’s Chaikin Money Flow (CMF) indicator is likely found at -0.27, suggesting a clear selling pressure in the market, with money flowing out of the asset. Notably, the deeper the value moves into negative territory, the stronger the bearish sentiment.

Besides, the 4-hour trading window of Solana reports a negative outlook. The price could fall toward the $139.26 support range. Further downside correction might push the price to test $137.05, with the emergence of the death cross. Conversely, with a reversal of momentum, SOL’s price might rise and surge past to challenge the immediate resistance level at $143.52. If the golden cross is taking place with the bulls gaining more strength, the price could potentially reach $145.73.

The daily Relative Strength Index (RSI) is settled at 30.46, showing that Solana is almost approaching its oversold territory. If it dips below the 30 zone, it may signal a sturdy bearish momentum, which may potentially bounce. Moreover, SOL’s Bull Bear Power (BBP) reading of -17.68 implies a stronger bearish dominance in the market. Also, with the sellers firmly in control of the asset, the price is likely pushed well below the average.

Top Updated Crypto News